BEYOND THE NUMBERS

The excise tax on high-cost health plans (or “Cadillac tax”) will initially affect a tiny share of workers and an even tinier share of health plan costs, according to recent estimates by the Treasury Department. The new estimates are much smaller than other frequently cited figures on the tax’s impact.

Health reform imposes an excise tax of 40 percent on the value of employer-sponsored health plans that exceeds $10,200 for individuals and $27,500 for families, starting in 2018. (Higher dollar limits apply in certain cases.) The thresholds will rise in tandem with the consumer price index (CPI) plus one percentage point in 2019 and with the CPI thereafter.

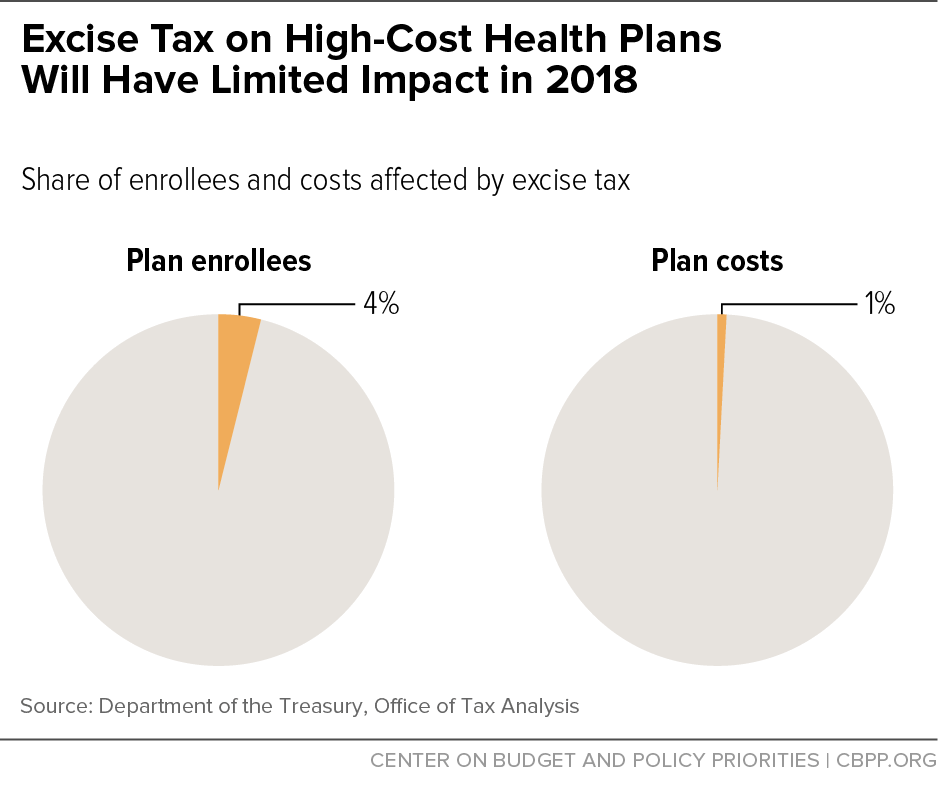

Only 4 percent of people with employer-sponsored coverage will be enrolled in plans whose projected costs exceed the thresholds in 2018, the Treasury’s Office of Tax Analysis estimates. Even this figure overstates the tax’s effect, however, since the tax applies only to the portion of plan costs over the thresholds. That’s just 1 percent of plan costs in 2018, Treasury finds. (See figure.)

These estimates are smaller than those at the time when Congress was considering the excise tax in 2009 and 2010. Congress’s Joint Committee on Taxation estimated that the Senate-passed version of the excise tax would have affected 3 percent of plan premiums in its first year and 7 percent of premiums by 2018. The new estimates are lower for two reasons. The enacted version of the tax raised the thresholds and adjusted them to reflect the age and gender composition of a firm’s workforce. Also, health costs have grown less rapidly than previously projected.

A recent Kaiser Family Foundation analysis employs a measure that exaggerates the excise tax’s impact. It counts employers who offer at least one health plan in which at least one participant would exceed the tax’s threshold by even one dollar, if that participant contributes the maximum possible amount to a health flexible spending account. By this metric, the tax could affect as many as one in four employers in 2018, although in the vast majority of cases the effect would be negligible or small, as the Treasury estimates show.

Some changes to the excise tax deserve consideration. For example, unless the thresholds rise more rapidly than the CPI, the tax will eventually affect a large share of health plans. But the tax’s basic concept is sound, and immediate changes aren’t required.