BEYOND THE NUMBERS

Virginia’s recently enacted 2017 budget creates a unit within the Joint Legislative Audit and Review Commission to track the cost and effectiveness of tax incentives designed to promote economic development. That’s a positive step: our 2014 report Budgeting for the Future lists oversight of tax expenditures (tax credits, deductions, and exemptions that reduce state revenue) as one of ten proven, common-sense planning tools that can help states chart their fiscal course accurately and make mid-year corrections when needed.

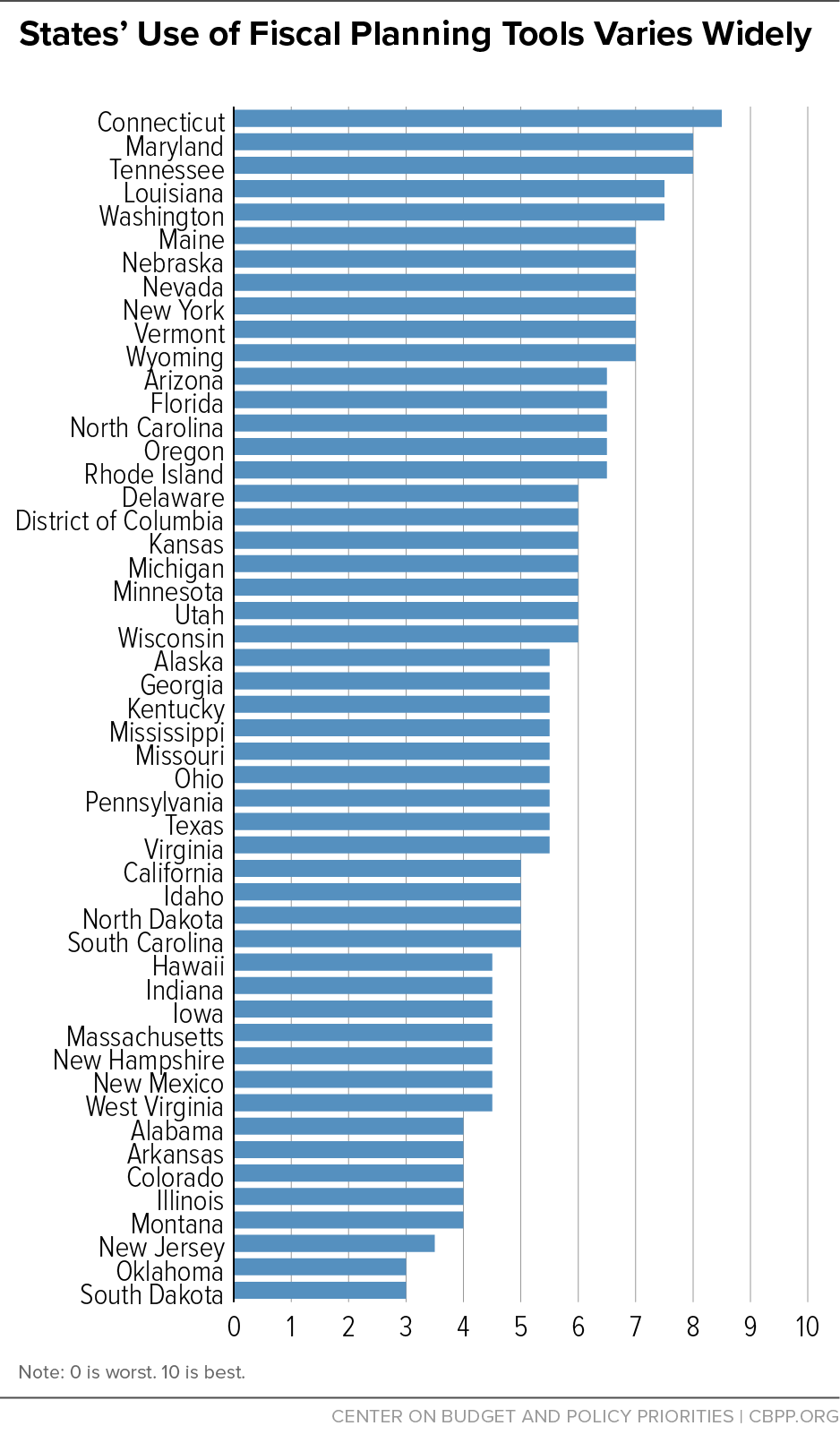

Our report found that states’ use of these tools — which also include regularly estimating revenues and spending for the next five years and establishing a “rainy day” reserve fund — varies widely. (See graph.) Connecticut, Maryland, and Tennessee do the best job of factoring long-term issues into their budget decisions, we found, while New Jersey, Oklahoma, and South Dakota do the worst.

The results cut across regional and partisan divides. For example, New York (the prototypical liberal northern state) and Louisiana (a southern state with a much more conservative bent) both do relatively good jobs of planning ahead, while both Massachusetts and Alabama have much room for improvement.

Long-term budget planning doesn’t dictate particular policies. Instead, it helps policymakers understand the impact of whatever policy they’re considering, whether expanding help for low-income students or eliminating the income tax.

States are grappling with a number of fiscal and demographic challenges, such as an aging population, rising health care costs, and increasingly outmoded sales tax systems, making long-term budget planning particularly important. By laying out a clear budget roadmap of the future, states can improve their business climate, better cope with economic ups and downs, and better manage the public investments that undergird a strong economy.