BEYOND THE NUMBERS

Policymakers need to replenish funding for the Disability Insurance (DI) program — a vital part of Social Security — by late 2016 to avert a sudden, one-fifth cut in benefits to a group of severely impaired and vulnerable Americans. Some critics claim that replenishing DI by reapportioning payroll taxes between the DI and retirement trust funds would jeopardize retirees, but that’s not the case, as our new paper explains.

Reallocating the shares of payroll taxes that go to the separate DI and Old-Age and Survivors Insurance (OASI) trust funds is a traditional and noncontroversial way to even out the programs’ finances. Lawmakers have enacted 11 such shifts, in both directions.

Here’s why another reallocation wouldn’t hurt retirees:

- The last two reallocations have shortchanged DI, underfunding it compared with the retirement program. Congress redirected a big chunk of payroll taxes from DI to OASI in 1983 and only partly offset that in a 1994 law. If DI’s tax rate had remained at its pre-1983 level, we wouldn’t need to replenish the fund today. Yet nobody claims that the 1983 reallocation, which helped stave off OASI’s imminent depletion, “robbed” DI — nor could they reasonably claim that reallocating in the other direction would “rob” OASI.

- A reallocation would have only a tiny effect on the retirement program’s solvency. Reallocating taxes to put the two trust funds on an even footing would prolong the DI trust fund by 17 years (from 2016 to 2033), while advancing the OASI fund’s depletion by just one year (from 2034 to 2033). The reason is simple: OASI is much bigger than DI, so a modest reallocation barely dents OASI. And before then, policymakers will almost surely address Social Security solvency in a comprehensive fashion.

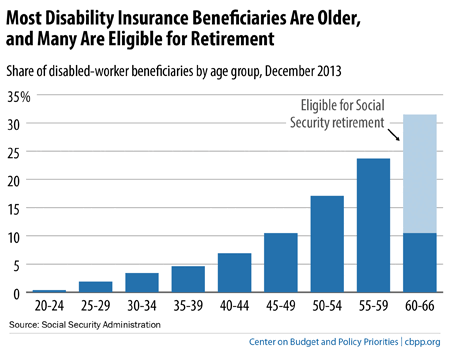

- Most DI recipients are older people, so helping DI helps seniors. The risk of disability rises with age, and most DI beneficiaries are older. Seventy percent of disabled workers are age 50 or older, 30 percent are 60 or older, and 20 percent are 62 or older and would actually qualify as early retirees under Social Security. (See graph.)

Neutral experts like the American Bar Association and the National Academy of Social Insurance, as well as retiree advocates like AARP and the National Committee to Preserve Social Security & Medicare, agree that reallocating payroll taxes is necessary and reasonable.

Policymakers should do so by 2016 to avert an unacceptable cut in DI benefits while working on the main goal: ensuring solvency for all of Social Security.