BEYOND THE NUMBERS

Bernstein on Income Inequality

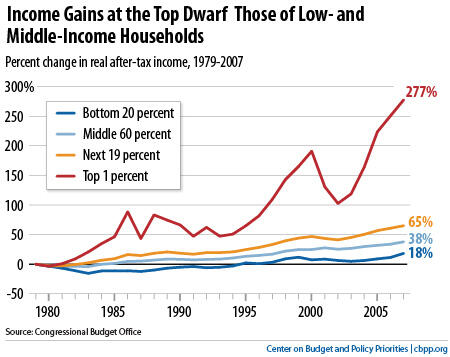

Testifying at a Senate Budget Committee hearing today on “Assessing Inequality, Mobility, and Opportunity,” CBPP Senior Fellow Jared Bernstein explained that, “even with recent improvements in the job market, the American economy still faces significant challenges, particularly the historically high levels of income and wealth inequality, the squeeze on middle-class incomes, and elevated rates of poverty.” Below are the main findings of his testimony:

- It is important to examine trends in income inequality through the lenses of various different data sources, as each has its own strengths and limitations. The fact that all of these series show similar trends toward increased dispersion of incomes is itself good evidence of the validity of their findings.

- A key factor driving the ups and downs in the inequality trend in recent decades is capital incomes, particularly capital gains; the fact that such income is given preferential treatment in our tax code relative to ordinary income from wages is thus a relevant issue for both inequality and tax reform.

- Some analysts and policy makers cite income mobility — movements by persons and families up and down the income scale over the course of their lifetimes, or from one generation to the next — as a reason why policy makers should be less concerned about historically high levels of inequality. However, a key finding here is that the rate of income mobility has not accelerated in recent decades; if anything, it may have slowed. Therefore, it is incorrect to argue that income mobility has offset the greater distance between income classes over time — i.e., higher inequality. It is also notable that there is considerably less mobility in the US than in most other advanced economies, including those with far lower levels of income inequality.

- These findings suggest a negative feedback loop wherein higher inequality is blocking key opportunities, such as educational attainment, that would in turn reduce inequality and enhance mobility.

- The potential interactions between our major economic and fiscal challenges remain a challenge for policy makers. Along with inequality, there is the related squeeze on low- and middle-class incomes, high rates of poverty, and the high, though declining, rate of unemployment. And, of course, a central concern of this committee is our bleak fiscal outlook. Addressing one of these problems could potentially exacerbate another.

For example, recent Congressional Budget Office analysis predicts that full and sudden expiration of the 2001 and 2003 tax cuts in 2013 would push unemployment higher. Similarly, cuts to programs that are supporting low and moderate income families, like nutritional assistance, the Earned Income Tax Credit, or the Child Tax Credit, could worsen poverty and inequality. This worsening would further exacerbate inequality if we were to then turn around and use some of these savings to lower taxes on the wealthiest households.

While this may sound fanciful, it is not. In fact, the 2011 budget proposed by House Republicans does precisely this. As analysis from the Center on Budget and Policy Priorities shows, almost two-thirds of that budget’s spending cuts over ten years — $2.9 trillion —come from programs targeted at households with low and moderate incomes. And those budget savings are used to support tax cuts for the wealthiest households.

With this in mind, a central question of this testimony is how policymakers can address these three problems — inequality, economic slack, and the fiscal path — without solving one problem at the expense of exacerbating another problem. Most pointedly, revenue and spending policies designed to put the nation on a sustainable budget path must not exacerbate inequality, poverty, or the ongoing middle-class squeeze.

Click

for the full testimony.