off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

The Netherlands — where disability reforms have tightened eligibility, trimmed benefits, and imposed greater responsibilities on employers — isn’t a model for Social Security Disability Insurance, according to a new paper by Elaine Fultz, a former House Ways and Means Committee staffer and International Labor Organization official.

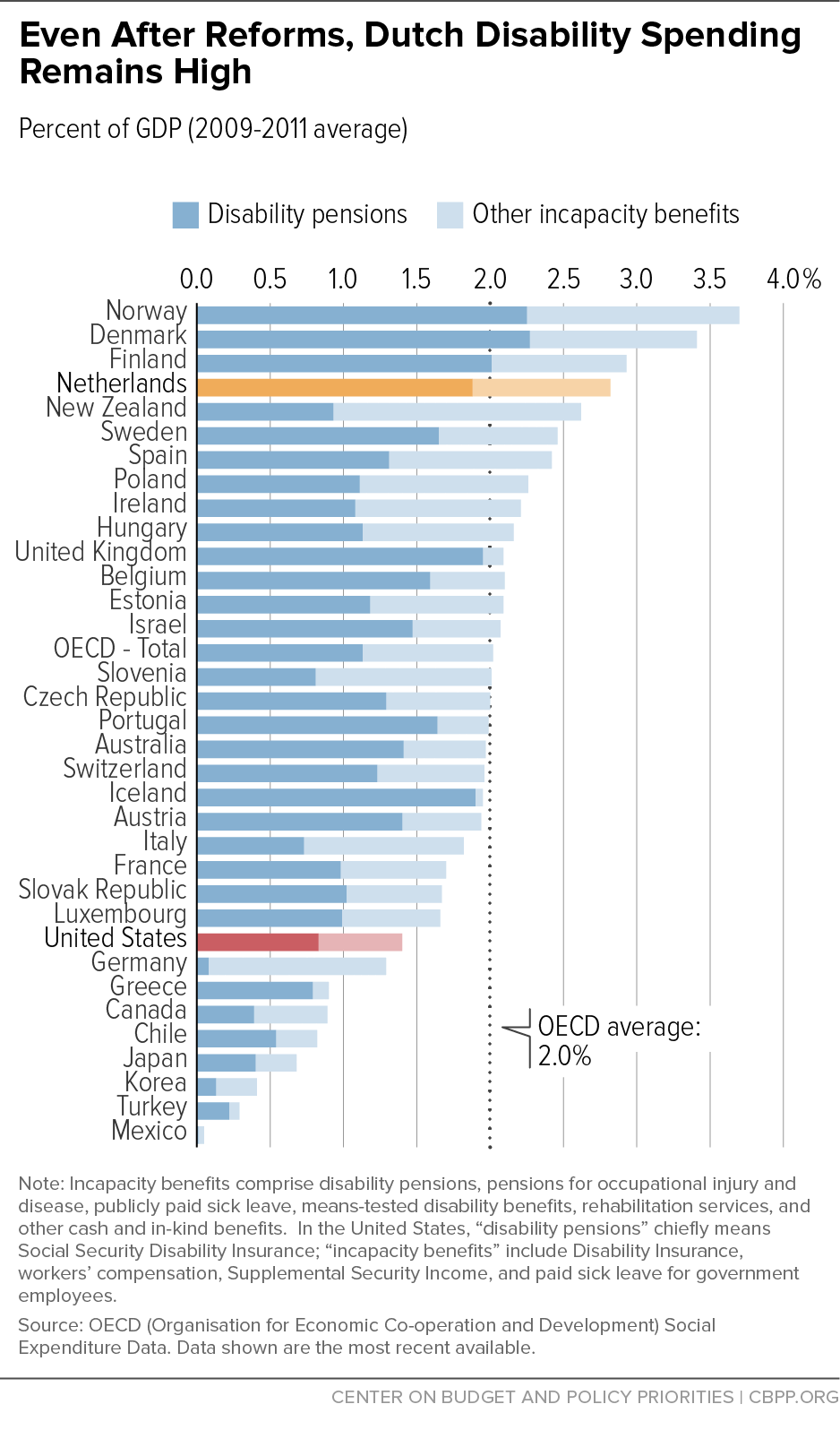

- The Dutch model is expensive. Even after the reforms, the Netherlands spends 40 percent more on disability and incapacity benefits as a percent of gross domestic product than the average developed nation and twice the U.S. amount. (See figure.) Benefits are generous (replacing 70 to 75 percent of pre-disability wages, compared to 50 to 55 percent, on average, in the United States), and less efficiently targeted to the less healthy.

- The Dutch cut public spending by shifting disability costs to employers. Heavy employer regulation is the centerpiece of the Dutch redesign of disability insurance. Dutch employers must hold a sick worker’s job open for two years while paying sickness benefits of at least 70 percent of prior wages. Employers must also implement and finance rehabilitation, cover certain forms of medical care, make workplace accommodations, find a new job for workers for whom they can no longer offer comparable employment, and prepare detailed reports on these efforts. The Dutch tradition of social partnership between the government, employer organizations, and trade unions, which made this approach possible, doesn’t exist in the United States.

- Shifting disability costs to employers may have made it harder for people with disabilities to find permanent work. Unemployment among the disabled has risen sharply in the Netherlands. Employers have apparently become more reluctant to hire people with health problems. They have also relied more on temporary workers, whose sickness and disability benefits are financed publicly rather than by their employer.

- Despite the reforms, work incentives for persons with disabilities remain less attractive than in the United States. The Dutch system reduces disability benefits by 70 cents for each euro earned. This 70-percent tax on earnings is less generous than the 50-percent reduction in Supplemental Security Income benefits and the zero loss for the first $1,090 of monthly earnings in Social Security Disability Insurance.

The paper is available here.

Topics:

Report

Disability Insurance Benefit Offset Could Harm Beneficiaries and Discourage Work

September 4, 2015

Stay up to date

Receive the latest news and reports from the Center