BEYOND THE NUMBERS

The wide gap between median renter income and median rent extended through 2019, new Census data show, highlighting that the housing affordability crisis existed before COVID-19 and the recession cost many renters their jobs. Policymakers must urgently provide emergency rental assistance to help families struggling to afford housing in the current crisis and take longer-term steps to address the underlying affordability problem that the new data reflect.

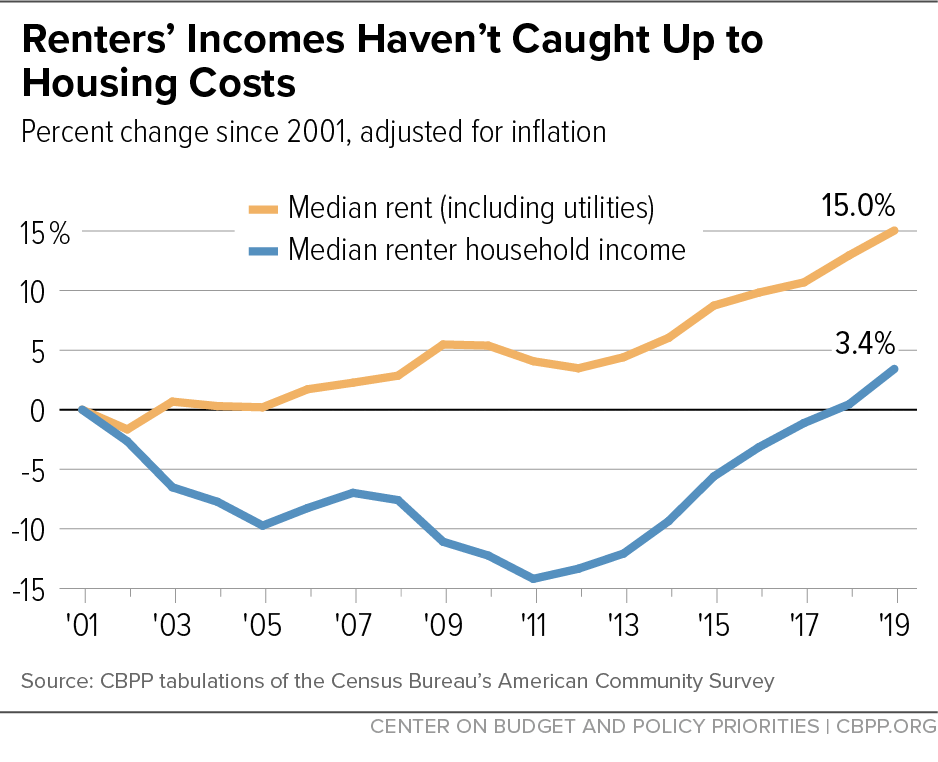

After adjusting for inflation, median rent rose 1.9 percent from 2018 to 2019, while median renter household income rose 3 percent, to $42,500. That did little to alter an 18-year gap between rent and incomes. From 2001 to 2019, median renter household income rose just 3.4 percent, while rents rose 15 percent. (See graph.)

After a long recovery from drops in renter incomes during the recessions that began in 2001 and 2007, 2018 marked the first year when renter household income was higher than in 2001. The COVID-19 recession, however, threatens to undo the gains of recent years.

Many renter households already struggled to pay their rent even before the current recession. Despite a strong job market and modest income growth, rising rental costs left many burdened by housing costs, paying over 30 percent of their income for housing (the federal standard of affordability).

Some 7.7 million renter households with very low incomes either pay more than half their income for rent or live in severely substandard housing, forcing them to divert funds from other basic needs like food or clothing and placing them at risk of eviction and homelessness. Federal rental assistance is a critical tool in addressing this hardship and helping low-income families keep a roof over their heads. But due to funding limitations, rental assistance has long reached only a small fraction of those who needed it.

Now, as the nation experiences its deepest recession since the 1930s, renters face much more unemployment and economic instability than in 2019.

The Census Bureau’s Household Pulse Survey shows high rates of hardship, with millions of renters falling behind on rent since March. Due to structural racism and employment discrimination, hardship is most acute among Black and Latino renters. These racial disparities are evident in the higher unemployment and greater likelihood of job loss among Black and Latino workers during the current recession compared to white workers.

With emergency housing assistance funds from the CARES Act of March becoming depleted, federal policymakers must enact a COVID relief package that significantly expands emergency federal rental assistance to avoid unprecedented spikes in evictions and homelessness. In addition, policymakers should take permanent steps to expand programs such as Housing Choice Vouchers to meet more of the unmet need for rental assistance that began well before the current crisis and that will persist after it’s over.