| FOR

IMMEDIATE RELEASE: September 4, 1999 |

CONTACT:

Jim Jaffe, Michelle Bazie |

Gaps Between High-Income and

Other Americans Will Reach

Record Level in 1999, Analysis Finds

View the entire report. |

The after-tax income gaps between those with the highest incomes and other Americans have widened sharply since 1977 and are projected in 1999 to reach their widest point in recent decades, according to an analysis by the Center on Budget and Policy Priorities of Congressional Budget Office data.

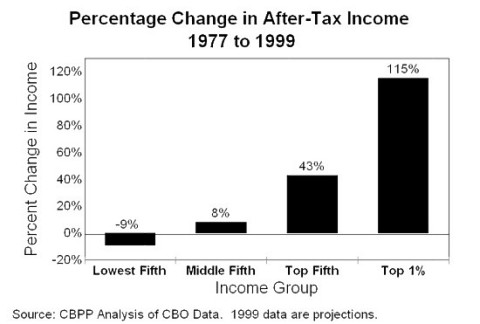

The average after-tax income of the richest one percent of the population is projected to more than double between 1977 and 1999, rising 115 percent after adjusting for inflation, the analysis found. But the average after-tax income for households in the middle of the income scale is projected to increase only eight percent over this 22-year period, an average real gain of less than one-half a percent per year, while the average income of the poorest fifth of Americans is projected to fall.

These conclusions are included in The Widening Income Gulf, a new analysis by the Center of CBO income and tax data released this summer. The data, which cover every other year from 1977 to 1995 and include CBO projections for 1999, are generally regarded as the most reliable and comprehensive data available on the distribution of after-tax income in the United States. They include various forms of income that standard Census Bureau data miss, such as capital gains income and income from the Earned Income Tax Credit.

Top 2.7 Million People Have as Much Income as Bottom 100 Million

As a result of the large increases in income disparities over the past two decades, with a highly disproportionate share of income gains having accrued to those on the upper rungs of the income scale, the analysis found that the richest one percent of Americans is projected to have as much after-income in 1999 as the 38 percent of Americans with the lowest incomes. In other words, the 2.7 million Americans with the highest incomes will have as much after-tax income as the 100 million Americans with the lowest incomes.

The analysis also found that the top 20 percent of households, a group that is expected to secure an average after-tax income gain of 43 percent between 1977 and 1999, is expected to receive slightly more than half of all after-tax income this year. These households will have slightly more income than the other 80 percent of households combined.

In 1999, both the richest one percent of households and the top 20 percent are projected to receive a larger share of the after-tax income in the United States than in any previous year on record since these data began being collected in 1977. Most other income groups, including the broad middle class, are expected to receive as small or smaller a share of the national after-tax income than at any point during this period.

|

The report also examined data on wealth and assets compiled in substantial part from Federal Reserve surveys and found wealth to be more concentrated at the top than at any time since the Depression. Wealth is much more concentrated than income, with the wealthiest one percent of households owning nearly 40 percent of the nation's wealth in 1995. The bottom 80 percent of households owned just 16 percent of the nation's wealth, less than half what the wealthiest one percent of the population possessed, the study reported.

Federal Tax Changes Exacerbated the Trend

The private economy is responsible for most of the widening of these income gaps, the study said, but changes in tax policy also have played a role. The CBO data show that the richest Americans now pay a significantly smaller fraction of their income in federal taxes than they did in the late 1970s.

The study found that the tax policy changes since 1977 have provided the top one percent of households with an average tax cut worth more than $40,000 in 1999. The average tax cut that the richest one percent of households has received exceeds the entire income of households in the middle of the income spectrum, the study said. CBO projects that the 20 percent of households in the middle of the income spectrum will have average income of $38,700 before taxes in 1999 and $31,400 after taxes.

"That income and wealth disparities are at record levels should figure in the debate over how to use projected budget surpluses," report co-author Isaac Shapiro said. "Government policies should lean against these trends, not exacerbate them."

Shapiro noted that the tax bill Congress approved August 5 appears indifferent to these trends, providing the bulk of its tax cuts to the households at the top whose after-tax income already has risen sharply, while providing only a small share of the tax cuts to the groups in the middle and bottom of the income scale whose incomes have changed little or declined. Treasury Department estimates indicate that when the bill is phased in fully, the top 20 percent of households would receive 78.5 percent of the tax cuts and receive an average tax cut of an additional $32,000 a year. The bottom 60 percent of households would receive 7.5 percent of the tax cut and receive an average tax reduction of $166 per year.

The Center on Budget and Policy Priorities is a nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

# # # #