Lower-Cost Estate Tax Repeal Reflects Slow Phase-In

Cost in the Second Ten Years Could Reach $1.3 Trillion

| View PDF of short version View HTML of full report View PDF of full report If you cannot access the file through the link, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

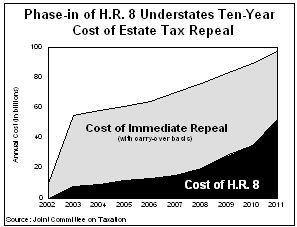

On April 3, the Center on Budget and Policy Priorities released Lower-Cost Estate Tax Repeal Reflects Slow Phase-In. The report explains that the House Ways and Means Committee bill (H.R. 8) to repeal the estate tax has a much lower cost than other repeal proposals — for example, it is less than one-third of the Joint Tax Committee's $662 billion estimate of a proposal for immediate repeal that is broadly similar to H.R. 8. The House bill achieves its lower cost by "backloading" — pushing off repeal to 2011 (two years later than the Bush proposal), and lowering the estate tax rate much more slowly in the intervening years than the Bush plan. The bill's new treatment of inherited capital gains ("carry-over basis") and anti-abuse measures are only effective once repeal takes affect in 2011, and thus have essentially no impact on the bill's ten-year cost. The report's findings include:

- Because repeal of the estate tax is delayed until 2011, the full cost of the Ways and Means bill does not occur until the years after 2011. In the ten-year period between 2012 and 2021, the bill will likely cost about $1.3 trillion, even when the modest cost-saving provisions in the bill are taken into account. The cost in the second ten years is more than six times the cost in the first ten years.

- The high cost in the second ten years reflects, in part, the impact of the widespread income tax avoidance that the Joint Tax Committee anticipates will occur as a result of repeal of the estate and gift tax. The Joint Tax Committee's estimate of immediate repeal shows that for every dollar of estate and gift tax revenue lost in 2011, an additional 80 cents of income tax revenue would also be lost.

- This $1.3 trillion cost between 2012 and 2021 could be reduced by several hundred billion dollars, but that would require subsequent action to identify, design, enact, and implement effective measures to prevent income tax avoidance. There are serious questions as to whether effective enforcement measures can be designed and implemented.

- The high cost of estate tax repeal in the years after 2011 is of

particular concern, because that is

when

the costs associated with the retirement of the baby boom generation will increasingly be

felt.

when

the costs associated with the retirement of the baby boom generation will increasingly be

felt.

- The Committee backloaded estate tax repeal to stay within the revenue targets set by the budget resolution the House approved on March 28, which reflects the Bush tax-cut target of $1.6 trillion over ten years (excluding interest costs). To date, the House has passed two tax bills (H.R. 3 and H.R. 6) that together have a ten-year cost of more than $1.3 trillion, leaving too little room for the remaining tax-cut proposals in the Bush plan. To make the pieces fit, the Committee backloaded estate tax repeal.