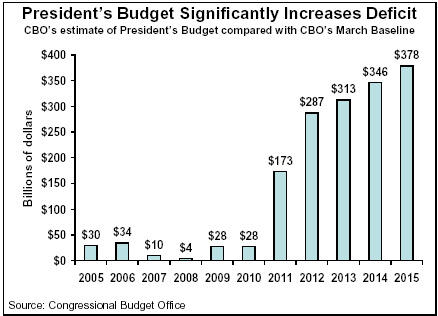

The analysis of the President’s budget released on March 4 by the Congressional Budget Office confirms that the President’s budget does not reduce the deficit.[1] In fact, according to CBO, adoption of the policies proposed by the President would increase the deficit by $104 billion over the next five years (2006 through 2010) and $1.6 trillion over the next 10 years (2006 through 2015), compared with the deficits that would occur if there are no changes in current policies.

The bulk of this increase in projected deficits was hidden in the President’s budget, because that budget only showed deficits through 2010. Although it was clear to observers that the tax cuts proposed by the Administration would push deficits up after 2010, the CBO estimates show for the first time how large the increases in the deficit would be in the five years following the years shown in the President’s budget.

CBO’s analysis starts with its baseline projections of the deficits that would occur under current policies. With funding for annually appropriated programs (so-called “discretionary” programs) assumed to remain at the 2005 level, adjusted only for inflation, and no changes in current laws governing entitlement programs or taxes, CBO projects that deficits will decline slowly over the next five years and then turn into modest surpluses beginning in 2012. Much of the projected fiscal turnaround after 2010 stems from the increase in revenues that will occur when the tax cuts enacted in 2001 and 2003 expire at the end of 2010, as is scheduled under current law.

It is the President’s proposal to make the 2001 and 2003 tax cuts (which primarily benefited taxpayers with high incomes) permanent — and to add new tax cuts on top of them — that is principally responsible for the increases in deficits that CBO projects the budget would cause. CBO estimates that the tax cuts proposed in the President’s budget would increase the deficit by more than $1.5 trillion in 2006 through 2015.[2] These tax cuts, and a proposed $336 billion increase in defense expenditures, would more than offset proposed reductions in expenditures for nondefense programs (a proposed $412 billion reduction in expenditures for annually appropriated programs other than defense, and a proposed $103 billion reduction in entitlement programs other than refundable tax credits).[3] Thus, the more than $500 billion in proposed cuts in nondefense programs would be used not to reduce the deficit but to offset a portion of the cost of the proposed tax cuts and defense spending increases.

It is important to note that CBO did not include in its estimate of the President’s budget any costs for items left out of the budget. For instance, because the budget did not include any new funding for military activities or reconstruction in Iraq and Afghanistan after this year, CBO did not include any such costs in its estimate. (CBO has estimated elsewhere that these additional costs could total more than $300 billion over the next 10 years.[4]) Similarly, because the President’s budget did not propose the extension of Alternative Minimum Tax relief, CBO did not include the more than $600 billion cost of extending the current AMT exemption amount, with an adjustment for inflation.

| Effect of the President’s Budget Proposals on Projected Deficits*

(in billions of dollars) |

| | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | | 2006-2010 | 2006-2015 |

| Tax Cuts** | 0 | 3 | 13 | 23 | 43 | 43 | 184 | 289 | 300 | 315 | 329 | | 125 | 1,543 |

| Entitlement Cuts*** | -3 | -3 | -12 | -13 | -11 | -12 | -12 | -12 | -11 | -9 | -9 | | -51 | -103 |

| Defense Appropriations | 31 | 34 | 22 | 20 | 28 | 34 | 37 | 38 | 39 | 40 | 42 | | 139 | 336 |

| Nondefense Appropriations | 1 | -2 | -17 | -30 | -39 | -46 | -51 | -54 | -56 | -58 | -60 | | -134 | -412 |

| Interest | 0 | 2 | 4 | 5 | 6 | 8 | 13 | 25 | 41 | 57 | 76 | | 25 | 237 |

| Total Deficit Impact | 30 | 34 | 10 | 4 | 28 | 28 | 173 | 287 | 313 | 346 | 378 | | 104 | 1,601 |

*Positive numbers represent an increase in the deficit

**Includes refundable tax credits

***Excludes refundable tax credits

Source: Congressional Budget Office |

It is certain that additional funding for Iraq and Afghanistan will be required, and the President and the Congress will not let the AMT affect more than 40 million taxpayers by the end of the decade, as will happen if there is no change in the AMT. Since the Administration ignored these costs in its budget, CBO did not include them in its estimate of the budget. Nor did CBO include the costs of the President’s proposal to establish a new system of private accounts as part Social Security reform, as the President did not include that proposal in the budget. As a result, CBO’s estimate of the increases in the deficit that would occur under the Administration’s policies understates the increases that would occur when policies left out of the budget are taken into account.