|

August 2, 2006

NEW HOUSE ESTATE TAX PLAN FEATURES SAME LOW EFFECTIVE TAX RATES AS EARLIER VERSION: Proposal’s Benefits Would Go Primarily to Largest Estates

by Aviva Aron-Dine and Joel Friedman

Just five weeks after approving drastic reductions to the estate tax, the House of Representatives has passed another piece of legislation that would make essentially the same changes (H.R. 5970). New data from the Urban Institute-Brookings Institution Tax Policy Center confirm that the new proposal reflects no significant change in policy. The data show that the new plan still would lower effective estate tax rates to low levels, yielding very large revenue losses. The data also show that the cost of the proposal would go primarily toward tax breaks for the wealthiest estates.

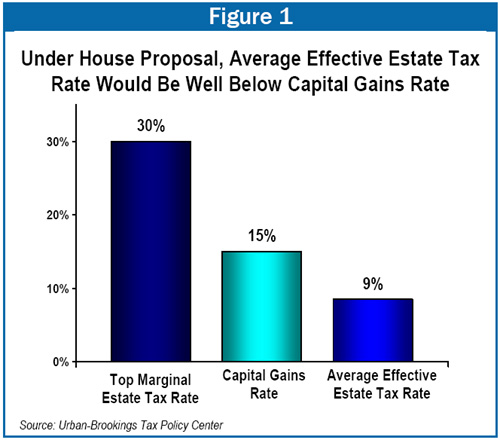

- TPC estimates that, once the House proposal was fully in effect, the fraction of an estate that would actually be paid in taxes — known as the effective tax rate — would average just 8.5 percent. [1] This is less than one-third the top estate tax rate, which the House plan would set at 30 percent. It is only slightly more than half the capital gains rate, to which the bottom estate tax rate would be tied, and it is well below the income and payroll tax rates that workers typically face. (The effective tax rate would be much lower than the top estate tax rate partially because, once the proposal was fully in effect, the first $10 million of a couple’s estate would be entirely exempt from tax.)

- The House proposal would raise the exemption level and lower the estate tax rate beyond the levels they would already reach under current law in 2009. The benefits of these costly additional reductions would go entirely to the 3 in 1,000 estates that would owe any tax if 2009 estate tax law were made permanent.

- Even within this small group of wealthy estates, the distribution of the benefits of the House plan would be skewed. More than 70 percent of the additional cost, relative to making 2009 estate tax law permanent, would go toward tax breaks for estates valued at more than $10 million. More than 40 percent of the additional cost would go toward providing tax cuts averaging $5.4 million apiece to estates valued at more than $20 million.

-

Some claim that estate tax reductions are needed to assist small businesses and farms. But the TPC data show that only one one-thousandth of the additional cost of the House proposal, relative to making 2009 estate tax law permanent, would go toward tax cuts for farm and small business estates valued at less than $5 million.

Large Revenue Losses Explained by Low Effective Tax Rates

Like the earlier House bill, the new legislation would, once it was fully in effect, exempt the first $10 million of an estate for a couple ($5 million for an individual). Also, as under the earlier bill, the value of an estate under $25 million would be taxed at the capital gains rate, which is now 15 percent and is scheduled to rise to 20 percent in 2011. The portion of an estate above $25 million would be taxed at a rate of 30 percent.

Joint Committee on Taxation estimates indicate that the new proposal would cost about 75 percent as much as full repeal over the long term, as compared with 76 percent in the case of the earlier House plan. Moreover, because the new proposal links the bottom estate tax rate to the capital gains rate, the Joint Tax Committee estimates (which assume that the rate would rise from its current 15 percent level to 20 percent in 2011) may well understate its true costs. If the capital gains rate remains at 15 percent — as the Republican Congressional Leadership intends — the new House estate tax proposal likely would cost about 80 percent as much as full repeal. [2]

The new TPC data help to explain this high cost. These data show that if the capital gains rate remains at 15 percent, so that the estate tax rates are 15 and 30 percent, the average effective estate tax rate under the new House proposal would be only 8.5 percent. Even if the capital gains rate reverts to 20 percent, so that the estate tax rates are 20 and 30 percent, the average effective estate tax rate would be just 9.7 percent, or less than half the 20 percent capital gains rate that would be in place.[3]

The effective estate tax rate is so far below the statutory estate tax rates because no estate tax is owed on the portion of an estate’s value below the exemption level. By 2015 under the House plan, a couple with an estate valued at $11 million would owe tax on $1 million at most. Further, some or all of the remaining value of an estate can be shielded from tax through available deductions, including deductions for charitable bequests. Many estates also employ planning devices to shrink the size of the estate before taxes are calculated. Such devices are not taken into account in the Tax Policy Center calculations, so the TPC estimates may actually understate true effective estate tax rates.

House Proposal Offers Huge Tax Breaks for Wealthiest Estates

Under current law, the estate tax exemption level will rise in 2009 to $7 million per couple ($3.5 million per individual). At that point, the estates of only 3 of every 1,000 people who die will owe any estate tax; the remaining 997 will be entirely exempt. The House proposal would raise the estate tax exemption and lower the estate tax rate beyond their 2009 levels, at considerable cost. Joint Tax Committee estimates indicate that the House proposal would cost about two-thirds more than simply making 2009 estate tax law permanent.

The benefits of these additional reductions would go to the 3 in 1,000 estates that would owe any tax under 2009 law. Even among those 3 in 1,000 estates, the distribution of the benefits would be skewed:

|

Table 1:

Change Due to House Estate Tax Proposal If Fully in Effect in 2011, Relative to Making 2009 Law Permanent* |

| Estate Value |

Average Tax Cut |

Share of Total Tax Cut |

| Less than $3.5 million |

$0 |

0% |

| $3.5 million - $5 million |

$280,000 |

5% |

| $5 million - $10 million |

$690,000 |

22% |

| $10 million - $20 million |

$1.9 million |

29% |

| Above $20 million |

$5.4 million |

43% |

| Total |

$1.3 million |

100% |

Source: Urban-Brookings Tax Policy Center.

* Table assumes that capital gains rate remains 15 percent. |

-

The few estates that would benefit from the House proposal, relative to making the 2009 estate tax law permanent, would receive tax breaks averaging $1.3 million apiece if the proposal were fully in effect in 2011.

- 43 percent — almost half — of the additional cost of the House proposal would be spent on additional tax cuts for estates worth over $20 million. These 800-900 estates — or the estates of 3 of every 10,000 people who die — would get tax cuts averaging $5.4 million each.

- By contrast, only 5 percent of the added cost of the proposal would go for additional estate tax reductions for estates with a value of less than $5 million. For estates in this category, the House plan adds little relief relative to making 2009 estate tax law permanent.[4]

End Notes:

[1] As discussed below, this assumes that the current capital gains rate of 15 percent would be extended beyond 2010.

[2] See Joel Friedman and Aviva Aron-Dine, “House Estate Tax Proposal Has Essentially the Same Large Long-Term Cost As Earlier Version: Phase-Ins Mask Costs, But Underlying Policy Remains Unchanged,” Center on Budget and Policy Priorities, July 28, 2006.

[3] TPC examined how the House proposal would affect the taxes that estates pay in 2011, if it were fully in effect in that year. See Tax Policy Center tables T06-0215 through T06-0222.

[4] If the capital gains rate rises to 20 percent, 94 percent of the additional cost of the proposal relative to freezing 2009 law would go toward tax breaks for estates larger than $5 million, and 43 percent toward tax cuts (which would average $4.9 million per estate) for estates larger than $20 million. |