Roth Tax Cut Would Cost Over $2 Trillion

in Second 10 Years

by Iris J. Lav

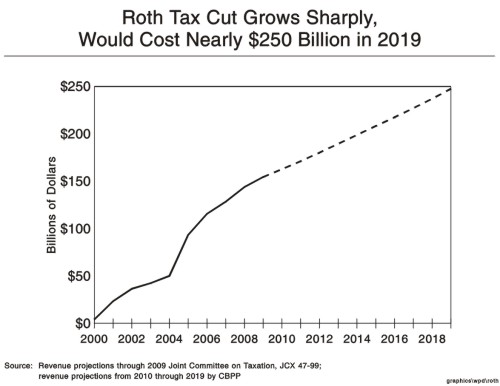

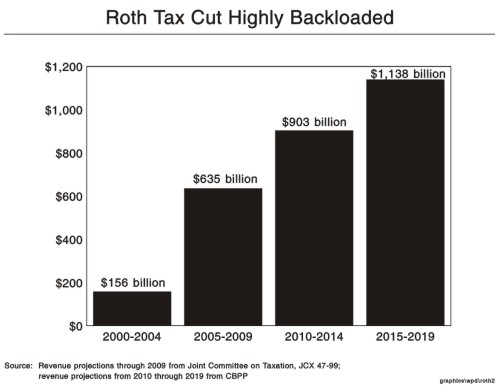

Estimates issued by the Joint Committee on Taxation place the cost of the tax-cut package proposed by Senate Finance Committee Chairman William Roth at $792 billion over the first ten years. The Joint Tax Committee estimates the plan would cost $156 billion in the first five years, with the cost jumping to $635 billion in the second five years. The Joint Committee estimates the annual cost of the package to be $154 billion in 2009 alone. The cost of the package is still rising rapidly at the end of the 10-year period.

Using conservative assumptions, we estimate the Roth proposal would cost more than $2 trillion in the second ten years, the years from 2010 through 2019. The proposal would cost more than 2 ½ times as much in the second ten years as the first ten.

The plan's cost grows sharply over time because many of its provisions phase in gradually. Among the provisions that are not fully effective until 2007 or later are: the increase in the income ceiling for the 15 percent tax bracket; the increase in the income limit for contributions to deductible IRAs; the new deductions for health insurance and long-term care insurance; and the increase in the estate tax exemption.

In estimating the plan's cost in the second ten years, we used conservative assumptions under which the cost of the bill would rise more slowly after 2009 than in the years before it. Specifically, we assumed that the cost of the package (except for three provisions relating to Individual Retirement Accounts) would grow from 2010 to 2019 at the same rate that the economy is expected to grow over this period.(1) The cost of tax cuts grows at the same rate as the economy, rather than at a faster rate, only when the tax cuts are in full effect and their revenue-loss impacts are no longer phasing in. Since the revenue loss effects of some of the non-IRA provisions of the bill may still to be phasing in for a period after 2009, this estimate of the bill's costs in the second ten years is likely to understate those costs somewhat.

The large costs that the plan carries in its second ten years would come in the same period that the baby boom generation begins to retire, Social Security, Medicare, and Medicaid long-term care costs mount and budget surpluses are expected to stop growing and start shrinking.

End Notes:

1. Costs for years after 2009 were projected as follows: The 2009 cost was increased at the same rate that CBO projects the Gross Domestic Product will be growing at the end of the 10-year period, a nominal rate of 4.4 percent per year. Additional adjustments were made to account for the full costs of the IRA expansions. Three of the IRA expansions — the increase in the annual contribution limits, the increase in AGI limit for deductible IRAs, and the elimination of the contribution limit for Roth IRAs — grow by more than 14 percent annually between 2007 and 2009. Research suggests that these types of IRA expansions do not reach their full cost for 10 to 15 years after they are in full effect, at which point new deposits and withdrawals reach equilibrium and costs stabilize. The Roth proposal phases in two of these three proposals, with the result that they would not take full effect for several years. Accordingly, in this estimate, the growth rate for the cost of the IRA expansions was reduced gradually each year subsequent to 2009, falling to the rate of growth of the economy in 2016 and beyond.