Revised July 15, 2003

THE

CAUSES AND SIGNIFICANCE OF THE NEW DEFICIT FIGURES

By

Richard Kogan

| PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

Today the Office of Management and Budget released new figures showing this year’s budget deficit growing to $455 billion. That figure is almost $800 billion worse than the projection for fiscal year 2003 that OMB issued in February 2001; at that time, OMB forecast a surplus of $334 billion in 2003. What happened?

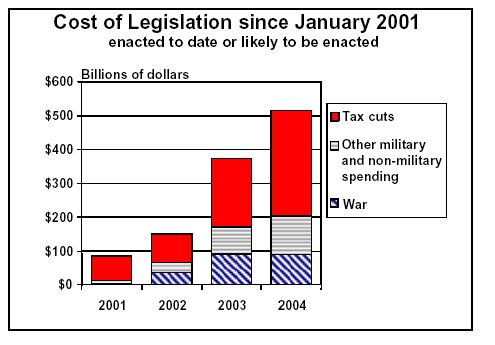

The President has blamed the war and the recession for the turnaround in the nation’s fiscal fortunes, ignoring the role of tax cuts.[1] Yesterday, White House spokesman Ari Fleischer again suggested the war is the culprit.[2] Congressional Budget Office data show, however, that the tax cuts enacted since 2001 will cost nearly three times as much over 2003 and 2004 as the combined costs of the fighting and occupation in Afghanistan and Iraq, the costs of reconstruction and relief after the September 11 terrorist attacks, increased expenditures for homeland security, and the cost of dealing with terrorism on a worldwide basis. The degree to which the cost of the tax cuts exceeds the cost of the war on terrorism will grow still larger in years after 2004.

| If the tax cuts are extended and other likely costs occur, deficits will total $4.1 trillion over the next ten years, will never fall below $325 billion in any year, and will reach $530 billion by 2013. |

These two factors — the recession and the end of the bubble — caused more than $400 billion in budget deterioration in 2003, as compared to the budget forecast of 2½ years ago. In retrospect, it was naïve to think the bubble/boom of the 1990s would continue forever.

The budget picture over the next ten years also is grim. In an analysis issued last week, we projected deficits totaling $4.1 trillion over the coming decade if tax cuts are extended and other likely costs (such as a prescription drug benefit) are incurred. Other analysts have reached similar conclusions: Peter G. Peterson, Chairman of the Concord Coalition, estimates $4.0 trillion in deficits over the next ten years, while Goldman Sachs projects $4.5 trillion in deficits.

|

The Orwellian Claim

that the Deficits are In response to the release of the new deficit figures today, House Republican leaders rushed to blame federal spending as the culprit and to absolve the large tax cuts enacted in recent years. House Majority Leader Tom DeLay termed the swelling deficit as a “spending-driven deficit.” House Budget Committee chairman Jim Nussle used the same phrase and explained: “Tax cuts do not cause deficits.…You only borrow money in Washington for spending. These are spending-driven deficits.” a In fact, deficits are caused by the imbalance between revenues and spending. Under the Nussle-DeLay theory, if policymakers cut spending but cut taxes more, thereby producing a deficit, the deficit would be “spending-driven” because spending would exceed revenues. Under this odd theory, one could cut taxes year after year — or even eliminate taxes altogether — and deficits would still be spending-driven, rather than caused by excessive tax-cutting. This construction of how tax cuts cannot cause deficits and deficits are always spending-driven is an example of what George Orwell called “doublethink.” a Alan Fram, “White House Projects Record $455 Billion Deficit,” Associated Press, July 15, 2003, 1:10pm EST. |

Our projection of $4.1 trillion in deficits over ten years includes within that figure $2.6 trillion in surpluses in the Social Security trust funds. Outside of Social Security, our figures show ten-year deficits totaling $6.7 trillion.

Higher deficits cause higher debt and thereby increase the level of government interest payments on the debt. Under our projection, interest payments would total $3.1 trillion over the 2004 – 2013 period. Both debt and interest would double by 2013 as a share of the economy. In contrast, in January 2001, OMB and CBO expected interest costs to net to approximately zero over this period as a result of the projected elimination of the debt.

|

$4.1 Trillion in Deficits Over Ten Years? Earlier this month, we issued an analysis finding that if the current tax cuts are extended and other likely costs occur, the deficits over the ten-year period 2004-2013 will total $4.1 trillion.* The figures used in today’s analysis and in that analysis are consistent with each other. These figures are based on the economic forecast CBO issued earlier this year and the most up-to-date CBO estimate of revenue collections for this year. * See $300 Billion Deficits, As Far As the Eye Can See, Center on Budget and Policy Priorities, revised July 8, 2003, at https://www.cbpp.org/7-2-03bud.pdf |

Once the budget effects of the current economic slump subside (i.e., by 2005 and thereafter), our projections show deficits leveling off for awhile at about three percent of Gross Domestic Product. No President in American history has run deficits that large during times of peace and prosperity, other than President Reagan. The Administration has defended these deficits as “manageable,” but that defense ignores certain realities.

Currently, the baby boom generation is in its peak earning years. Deficits will start rising again, well beyond three percent of GDP, when the baby boomers reach retirement age at the end of the decade, and the costs of Medicare, Medicaid, and Social Security begin growing substantially as a share of GDP.

The best way to prepare for the increased costs of these programs when the baby boomers retire in large numbers would be to reduce or eliminate the debt during this decade and thereby reduce or eliminate the cost of interest payments on the debt. Saving for the future — and shrinking the debt constitutes saving for the future — would offset a portion of the inevitable cost increases in Medicare, Medicaid, and Social Security and thereby partly relieve the pressure to cut these programs, cut other federal programs sharply, or raise taxes substantially in future decades.

Instead, debt and interest costs are now on track to swell, not to subside. Rather than preparing for the future by putting our finances in order before the baby boomers retire, we are going deeper into debt and at just the wrong time, making our already serious long-term budget problems substantially more severe. It is perhaps for this reason that Goldman Sachs now calls the nation’s long-term budget outlook “terrible, far worse than the official projections suggest.”[3]

End Notes:

[1]

“But this nation has got a deficit because we have been through a war. …

And we had an emergency and a recession, which affected the revenue

growth of the U.S. Treasury.” Statement of President Bush at the Timkin

Company,

[2]

“Asked yesterday about growing war costs and budget deficits, White

House Spokesman Ari Fleischer cited the terrorist attacks on

[3]

Bill Dudley and Ed McKelvey, “Budget Blues: Play It Again, Uncle Sam,”

Goldman Sachs,