|

Revised November 20, 2006

TOGETHER, STATE MINIMUM WAGES AND

STATE EARNED INCOME TAX CREDITS MAKE WORK PAY

by Jason A. Levitis and Nicholas Johnson

In recent years, federal policies aimed at ensuring adequate income for working families have not kept up with inflation, leaving many working families struggling to make ends meet. The particular culprit is the federal minimum wage, which has not been adjusted for inflation since 1997. Other policies such as the federal Earned Income Tax Credit (EITC) have not been adjusted sufficiently to take up the slack.

In response, many states are enacting minimum wages and EITCs, or are considering such measures. State minimum wages and EITCs are important policies for fighting poverty and making work pay, and together they are even more effective.

The minimum wage is part of a long tradition of work regulations intended to protect workers from unfair and unsafe working conditions. It helps the lowest-wage workers — those least able to negotiate fair compensation on their own — and its benefits accrue disproportionately to low-income families. The EITC is targeted at low- to moderate-income working families, primarily those with children.

The federal minimum wage was last updated to $5.15 per hour in 1997, and since then it has lost 20 percent of its buying power due to inflation. The income limits and benefit ceilings for the federal EITC are adjusted for inflation annually, but these adjustments do not compensate for the deterioration of the minimum wage. Moreover, because the EITC is tied to workers’ earnings, flat wages often result in a flat EITC — and reduced buying power over time. The after-tax income of EITC-eligible families with a full-time, minimum-wage worker and children has not increased since 2004, and will not increase again under current law.

The desire to improve upon federal policy has led 35 states (counting the District of Columbia as a state) to enact minimum wages higher than $5.15 per hour and/or state EITCs, which are generally set as a fixed percentage of the federal EITC. Fourteen of those 35 have passed both policies. Fifteen states have passed minimum wages but no state EITC. Six have passed EITCs but not increased their minimum wages. In the past year alone, sixteen states have increased their minimum wages and two have instituted EITCs.

Both state minimum wages and state EITCs have much to commend them individually. But a number of factors make them particularly effective in combination. Each policy reaches families that the other policy does not, and the combination provides added help to the working families who need it most. The EITC increases as income rises for very low-income families, so boosting the minimum wage also increases some families’ EITCs — both federal and state. The benefits of the two policies are timed differently — the minimum wage increases every paycheck, whereas state EITCs are paid annually — so they help families meet different types of expenses. And the combination allows the public and private sectors to share the cost of adequately compensating working families.

Federal Policies Have Not Kept Pace with the Cost of Living

Two key federal policies that support adequate after-tax income for working families are the minimum wage and the Earned Income Tax Credit (EITC). Together, these policies are intended to ensure that workers receive compensation adequate to provide for their families, and to maximize the work incentive for persons at the edge of the labor market. But in recent years the value of the federal minimum wage has deteriorated significantly due to inflation, and the small adjustments to the federal EITC have not been enough to compensate.

The Federal Minimum Wage Has Lost 20 Percent of Its Value

The federal minimum wage is part of a long tradition of work regulations intended to protect workers from unfair and unsafe working conditions. Like child labor laws, the minimum wage controls the terms under which firms can employ workers; it helps to ensure that workers with little negotiating power are not exploited.

Unless it is periodically increased, the federal minimum wage steadily loses value because of inflation. Since it was enacted in 1938, the minimum wage has been raised dozens of times, most recently in 1997, to $5.15 per hour. This amounts to $10,712 per year for a person working 40 hours per week, 52 weeks per year.[1] Since 1997, inflation has reduced the buying power of the minimum wage by 20 percent. Its buying power now stands at its lowest level since 1955 — a third lower than its peak in 1968.[2] With federal action to increase the minimum wage a distant prospect, its value is likely to continue to decline year after year.

The minimum wage is sometimes depicted as a benefit mostly for second earners or teens in middle-income families, but this is not the case. The average minimum wage worker brings home 54 percent of his or her family’s weekly earnings.[3] If the minimum wage were to increase to $7.00 per hour, the poorest 40 percent of U.S. households would receive 60 percent of the benefit.[4]

The Federal EITC Is Not Enough To Help Many Families Get By

The EITC is among the most effective and widely supported federal programs for working families. First enacted in 1975 under the Ford Administration, it was championed and expanded by President Reagan and further expanded under each president since. A large body of research has found it effective in encouraging workforce participation and family asset-building. (See box below.) It also offsets the significant cost of other taxes (payroll taxes, excise taxes, etc.) that low-income families face. In 2003, about 22 million working families claimed the credit.[5]

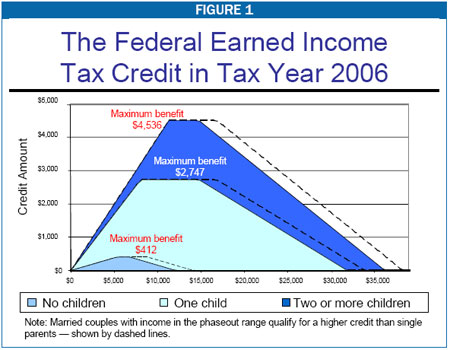

The benefit a family receives from the EITC depends on the composition of the family (number of adults and children) and on the family’s earning. Figure 1 illustrates the structure of the federal EITC. It shows that for families with very low earnings, the value of the EITC increases at a fixed matching rate as earnings rise. For example, a family with two or more children earning less than $11,340 receives an EITC equal to 40 cents for each dollar earned. Above this phase-in range, the EITC holds steady for a while at its maximum level, which is $4,536 for a family with two or more children. The credit then gradually phases out, beginning at $16,810 for married couples with children and continuing up to $38,348 for two-parent families with two or more children. Because the phase-out is gradual, families do not face the sudden loss of benefits that can create a disincentive to work.

The Internal Revenue Service, which administers the EITC, adjusts both the maximum credit and the income parameters used to calculate the credit annually to account for inflation. But the matching rates used to calculate the credit for families in the phase-in range do not change. As a result, for these families the benefit increases only when underlying income does. For example, in 2005 a family with two children and a minimum-wage worker received a benefit equal to 40 percent of $10,712, or $4,285. If in 2006 this family’s income remains at $10,712, then its EITC remains at $4,285. The problem in such a case is that the cost of living — rent, food, transportation, etc. — is higher in 2006 than it was in 2005. So the real value of both wages and the ETIC has declined.

|

Research Finds EITC Effective at

Encouraging Workforce Participation and Asset Building |

|

Increases Workforce Participation. Extensive research has found that EITCs encourage workforce participation among low-income parents. In a series of studies on the EITC, Harvard economist Jeffrey Liebman noted that workforce participation among single women with children has risen dramatically since the mid-1980s, while there was no increase in work effort among single women without children. Studies by Liebman and University of California economist Nada Eissa find a sizable EITC effect in inducing more single women with children to work. In addition, a study by Northwestern University economists Bruce Meyer and Dan Rosenbaum finds that EITC expansions explain more than half of the increase in employment among single mothers over the 1984-1996 period. Of note, Meyer and Rosenbaum found evidence that state EITCs also contributed to workforce participation increases in the states where credits were available. A very recent study confirms a very strong connection between the size of a family’s EITC benefit and its likelihood of employment. Authors V. Joseph Holtz, Charles H. Mullin, and John Karl Scholz found that welfare-recipient families with two or more children experienced noticeably faster rates of employment growth than families with one child because the larger families were eligible for greater EITC payments.

Encourages Asset Building. Research has also found that families use their EITCs to make investments that over the long term will build assets and reduce their dependence on government benefits. In 1996, a team of researchers from Syracuse University and the Center for Law and Human Services found that over half of surveyed EITC recipients spent some or all their EITC refunds on financial investments or human capital investments, including paying for tuition or other education expenses, increasing access to jobs through car repairs and other transportation improvements, moving to a new neighborhood, or putting money in a savings account. Thirty-three percent of surveyed EITC recipients planned to save a portion of their tax refunds. |

For families with higher income, the EITC increases annually to keep up with inflation, so its buying power is constant from year to year. But it does not compensate for the inflation-adjusted loss of income experienced by families whose income does not increase year to as year, such as those with workers earning the minimum-wage year after year.[6]

Stagnation of Federal Policies Hurts Working Families

The failure of federal policies to keep up with the cost of living makes it harder for working families to make ends meet.

Many working families are slipping below the poverty line. In 1997, there were 1.46 million families with a full-time worker and children living in poverty in America.[7] By 2004, there were 1.81 million such families, an increase of 24 percent.[8] In 1997, 25 percent of families with children living in poverty included a full-time, year-round worker. By 2004, 31 percent of poor families with children included a full-time, year-round worker. The erosion of the minimum wage is part of the reason.[9]

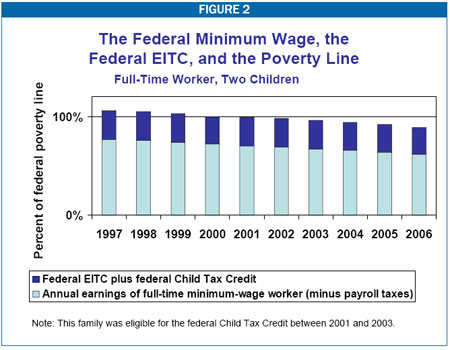

To see the impact of the minimum wage and EITC on working families, consider a family composed of a full-time worker earning the minimum wage and two children. The worker earns pre-tax wages of $10,712 per year. In 1997, the worker paid $819 in federal payroll taxes and received an EITC worth $3,656, for take-home earnings of $13,549. The federal poverty line for a family of three in 1997 was $12,802, so the combination of the federal minimum wage and the federal EITC was enough, in 1997, to raise this family’s after-tax income above the poverty line. See Figure 2.

In 2006, the federal minimum wage still amounts to $10,712 per year, of which federal payroll taxes still take $819. The EITC for the family of three has increased to $4,285, for take-home earnings of $14,178. Because of annual inflation, the poverty line for this family has increased to about $16,013.[10] In other words, a family of three supported by a full-time minimum-wage earner now brings home about only 89 percent of poverty-level income. Moreover, this family’s EITC has not increased since 2004, and will not do so again under current law. With its after-tax income fixed, this family will have less buying power with each passing year.

Many families with earnings above the official federal poverty line also have difficulty making ends meet. Studies have consistently found that the basic costs of living — food, clothing, housing, transportation, and health care — in most parts of the country exceed the federal poverty line, sometimes substantially.[11]

Many moderate-income families are affected by the federal minimum wage and EITC. Some minimum-wage earners are part of a family that also includes a full-time work earning more. Others work multiple part-time jobs to make ends meet, or work a part-time job in addition to a full-time job. If these families have children, they may also be eligible for the EITC. For these families living above the poverty line, the erosion of federal policies makes it harder to climb into the middle class.

Thus families supported by full-time workers earning the federal minimum wage and receiving the federal EITC are seeing their after-tax income slip year after year.

State Responses to Flagging Federal Effort

With federal policies increasingly insufficient, many states are stepping in. As at the federal level, the primary state policies for augmenting the take-home pay of low-income families are state minimum wages and state EITCs. Thirty-five states have passed a state minimum wage higher than $5.15 per hour or a state EITC, or both. Of these 35, fourteen have enacted both, while fifteen have a state minimum wage above $5.15 but no EITC, and six have a state EITC but no meaningful minimum wage.[12] See Table 1. Many of the states with only one of the two are considering the other, and some states with neither are considering both.

State Minimum Wages

Twenty-nine states (and several localities) have enacted minimum wages higher than $5.15 per hour. They range from as low as $5.25 for small businesses in Minnesota to as high as $7.63 in Washington, where the minimum wage is indexed for inflation. In 2006 alone, Arkansas, Arizona, California, Colorado, Delaware, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, North Carolina, Ohio, Pennsylvania, and Rhode Island have passed minimum wages or minimum wage increases; Connecticut, the District of Columbia, New Jersey, New York, Vermont, and Wisconsin are currently phasing in increases. By late in 2007, over half of the 29 will have minimum wages over $7.00 per hour. Other states are considering similar actions. Raising the minimum wage by June 2007 to at least $7.25 in every state would benefit an estimated 6.6 million workers, or 5 percent of the workforce.[13]

State EITCs

The enactment or expansion of state EITCs has the potential to benefit every family that receives the federal EITC: about 22 million in 2003, as previously noted. Since the late 1980s, 20 states have enacted EITCs, including four states in the past two years: Delaware, Michigan, Nebraska, and Virginia. The number of families benefiting from state EITCs is approaching five million.

State EITCs are very simple. They are typically set at a flat percentage of the federal credit. In other words, a family’s state EITC equals its federal credit multiplied by a given percentage rate — for instance, 30 percent in New York, 20 percent in New Jersey, 6 percent in Indiana, and 15 percent in Kansas. Thus a New York family that receives a $3,000 federal EITC would qualify for a $900 New York State EITC (thirty percent of $3,000).

|

TABLE 1: WHICH STATES HAVE EITCs

AND/OR MINIMUM WAGE HIGHER THAN FEDERAL? |

| Both Minimum Wage Higher than Federal and State EITC |

Minimum Wage Higher than Federal Only |

State EITC Only |

| Delaware |

Alaska |

Iowa |

| District of Columbia |

Arizona |

Indiana |

| Illinois |

Arkansas |

Kansas |

| Maine |

California |

Nebraska |

| Maryland |

Colorado* |

Oklahoma |

| Massachusetts |

Connecticut |

Virginia |

| Michigan |

Florida |

|

| Minnesota |

Hawaii |

|

| New Jersey |

Missouri |

|

| New York |

Montana |

|

| Oregon |

Nevada |

|

| Rhode Island |

North Carolina |

|

| Vermont |

Ohio |

|

| Wisconsin |

Pennsylvania |

|

| |

Washington |

|

*Colorado also has a state EITC on the books, but it has been suspended since 2001 and under current law will not resume until 2010.

Sources: U.S. Department of Labor, Employment Standards Administration, Wage and Hour Division, Center on Budget and Policy Priorities. |

The administrative cost of an EITC for a state is even lower than for the federal government, because the Internal Revenue Service does much of the work. The federal government uses mechanisms such as large databases of Social Security numbers to screen for ineligible EITC applicants and reject their claims. States, in effect, piggyback on these federal enforcement mechanisms.

Like the federal EITC, state EITCs have received broad support. EITCs have been enacted in states led by Republicans, in states led by Democrats, and in states with bipartisan leadership. The credits are supported by business groups as well as by social service advocates.[14]

|

State Taxation Disproportionately Burdens Poor Families

Another reason low-income families need income support is to make up for the large tax burdens they face in many states. While the federal income tax exempts families living in poverty, low-income working families pay substantial amounts of state and local income taxes, general sales taxes, excise taxes, property taxes, and local wage taxes, among others. According to the Institute on Taxation and Economic Policy, in 2002, the lowest-income 20 percent of households paid, on average, 11.4 percent of their incomes in state and local taxes, a higher share than any other income group. |

Why States Should Enact Both Minimum Wages and EITCs

State minimum wages and state Earned Income Tax Credits provide substantial benefits to working families when enacted separately, but they are especially valuable when both policies are in place. Each policy magnifies the other’s impact and reaches populations that the other misses.

The two policies can work together to help families make ends meet.

Neither an increased minimum wage nor a state EITC, by itself, guarantees that a working family can meet the basic cost of living. But the combination of the two policies goes further toward meeting this goal than either one alone.

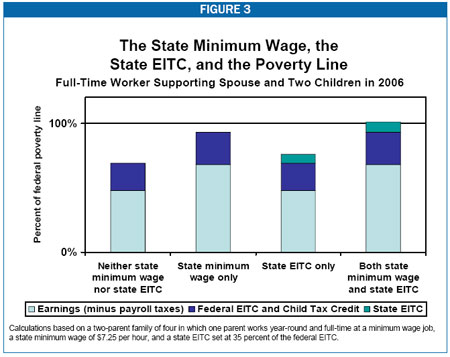

For example, in 2006, a full-time, year-round worker earning the federal minimum wage and supporting a spouse and two children has after-tax income of $14,178, far below the federal poverty line of $20,520.[15] A state EITC set at 35 percent of the federal EITC would increase the family’s take-home pay to $15,678, leaving the family’s income almost 25 percent below the poverty line.[16] See Figure 3. A state minimum wage of $7.25 per hour alone would increase this family’s take-home pay to $19,029[17] — still about $1,000 below the poverty line.

With the combination of a state minimum wage and a state EITC, by contrast, the picture improves. With a $7.25-per-hour minimum wage and a state EITC set at 35 percent of the federal EITC, this family’s take-home pay rises over the poverty line to $20,617.[18]

For families eligible for both, a state minimum wage generally increases after-tax income more than a state EITC. For example, for a one-parent family of three in which the parent works a full-time, minimum-wage job in 2006, a state minimum wage of $7.00 per hour increases after-tax income by $4,294, while a 30% state EITC is worth $1,285. On the other hand, the EITC may reach a broader range of families, particularly families with children.

The two policies target overlapping but different populations.

The minimum wage and EITC are targeted differently, so enacting both policies benefits more working families than either alone. While both policies benefit only working families, the EITC is limited to families with low-to-moderate incomes, and primarily to those with children. Childless adults under 25 and over 64 are ineligible. The minimum wage, on the other hand, is targeted at the workers in the state earning the lowest hourly wages, regardless of family status or total family income. The overlap is substantial but not complete.

Many low- to moderate-income working families with children benefit from an EITC but receive little or no help from a minimum wage increase. For example, a single parent of two working half time at $11 an hour takes home $15,122 in 2006, which is about $900 below the poverty line. A $7.50 minimum wage might not help this family, but a 20 percent EITC would raise its income above the poverty line.

By contrast, families without children receive little benefit from a state EITC. A single adult working full-time at the federal minimum wage ($10,712) is eligible for a federal EITC of $108 — less than one-eighth of her federal tax liability. Since it is based on the federal EITC, a 35 percent state EITC would be worth only $38, leaving her take-home pay at $9,812. A $7.25-per-hour state minimum wage would help far more, raising her after-tax income to $13,263. State minimum wages also help families with multiple workers in which at least one worker earns the minimum wage.

For many families, a higher minimum wage increases the value of the EITC.

Many families with a minimum-wage worker earn little enough that their EITCs are in the phase-in range, i.e., increasing for every additional dollar they earn. For such a family, a state minimum wage increases its state EITC and, even more significantly, its federal EITC — thereby drawing federal money to the state.

For example, in 2006 in a state with a 35-percent EITC, a family with two or more children and a year-round, full-time worker at the federal minimum wage would receive EITCs of $4,285 from the federal government and $1,500 from the state. A small state minimum wage increase of just 35 cents per hour, to $5.50, would increase the family’s pre-tax income from $10,712 to $11,440. But the minimum-wage increase would also result in $339 more in EITC benefits — $251 from the federal EITC and $88 from the state.[19]

Thus, a state minimum wage can increase the value of the EITC a family receives, particularly the federal EITC. States that already have a minimum wage or an EITC can help working poor families more by enacting the other policy than can states without either.

The policies benefit working families at different times.

Beneficiaries of state EITCs receive their credits in annual lump payments when they file their income taxes. The benefits of a minimum wage, by contrast, are distributed through every paycheck. As a result, the two policies help working poor families with different types of expenses. The minimum wage provides a steady stream of assistance for regular costs such as food, rent, and gasoline. The EITC lends itself to larger irregular expenses that are important to families seeking to escape poverty, such as car repairs and housing upgrades.[20] Families receiving the benefit of both policies are assisted in meeting both their regular and irregular expenses.

The combination allows the public and private sectors to share the cost of increasing the take-home pay of working families.

Combining a state minimum wage with a state EITC distributes the costs of making work pay among key stakeholders. The cost of a minimum wage increase is borne principally by the private sector, especially employers and consumers. The cost of a state EITC is borne principally by the state government and, by extension, the taxpayers in the state. Determining the precise locus of the cost and benefit of these provisions is complicated. As noted above, the two programs interact with each other, as well as with other federal and state taxes and programs — some of which bring money into the state. The sum of these costs and benefits is difficult to predict, but there is little question that the combination spreads the cost of ensuring adequate compensation for work more broadly than does either policy alone.[21]

Conclusion

Every state has an interest in reducing poverty among its residents, making work pay, and building a middle class. With federal policies failing to keep up with the cost of living, states are now leading this effort by instituting minimum wages and Earned Income Tax Credits of their own. Each of these policies is valuable in isolation, and their combination is even more effective.

End Notes:

[1] The first minimum wage was 25 cents per hour and applied only to workers engaged in interstate commerce or the production of goods for interstate commerce. Since 1967, a federal minimum wage has applied to all hourly workers. See www.dol.gov/esa/minwage/chart.htm#2.

[2] CBPP calculations based on Department of Labor data.

[3] Economic Policy Institute, “Minimum Wage Facts at a Glance,” 2006.

[4] Jeff Chapman and Michael Ettlinger, “The Who and Why of the Minimum Wage,” Economic Policy Institute, 2004.

[5] IRS Statistics on Income.

[6] In 2001, Congress passed an adjustment to the EITC that increases in 2005 and 2008 the income ceiling for married-couple families whose incomes are in the phase-out range. As a result, in 2008 some two-parent families will receive an after-inflation increase in their EITC.

[7] U.S. Census Bureau Current Population Survey, March 1998 Supplement to Annual Demographic Survey.

[8] U.S. Census Bureau Current Population Survey, March 2005 Supplement to Annual Demographic Survey. Over the same period (1997 to 2004), the total number of families with children and a full-time worker increased only 8 percent.

[9] Poverty status is measured before taxes and before government programs, so these calculations do not reflect the impact of the EITC. Since the EITC did not change substantially during this period, figures based on after-tax income would show similar changes.

[10] Poverty line is from the Census Bureau, updated from 2005 to 2006 using Bureau of Labor Statistics estimate of CPI change.

[11] See, for example, Sylvia A. Allegretto, Basic family budgets: Working families' incomes often fail to meet living expenses around the U.S., Economic Policy Institute, September 2005.

[12] A number of states have state minimum wages equal to or below the federal minimum wage. See “Minimum Wage Laws in the State,” Department of Labor, available at www.dol.gov/esa/minwage/america.htm.

[13] Economic Policy Institute, “Minimum Wage Facts at a Glance,” 2006.

[14] For more information on state EITCs, see Ami Nagle and Nicholas Johnson, A Hand Up, Center on Budget and Policy Priorities, 2006.

[15] The figure for take-home pay equals $10,712 minus $819 in federal payroll taxes plus an EITC of $4,285. The poverty line is calculated based on Census Bureau figures updated using year-to-year estimates of CPI change from the Bureau of Labor Statistics.

[16] This figure equals the $14,178 cited above plus a state EITC worth $1,500.

[17] This figure equals the pre-tax income offset by $1,154 in federal payroll taxes and supplemented by a $4,536 federal EITC and $567 federal child credit.

[18] This figure equals the $19,029 cited above plus a state EITC worth $1,588.

[19] Many minimum-wage-earning families with one child are also in the phase-in range, often because their bread-winner(s) work less than year-round and less than full-time. These families would also see an increase in their EITCs under a state minimum wage.

[20] In 1996, a team of researchers from Syracuse University and the Center for Law and Human Services surveyed close to 1,000 EITC recipients. Over half of those surveyed spent some or all their EITC refunds on financial investments or human capital investments, including paying for tuition or other education expenses, increasing access to jobs through car repairs and other transportation improvements, moving to a new neighborhood, or putting money in a savings account. Timothy M. Smeeding, Katherin E. Ross, and Michael O’Connor, “The EITC: Expectation, Knowledge, Use, and Economic and Social Mobility,” National Tax Journal, December 2000.

[21] The issue of who bears the ultimate cost of the state minimum wage and EITC is complicated by various factors. As noted above, increasing the minimum wage leads to a larger state EITC for many families with minimum-wage workers. But it also increases the federal EITC they receive, which brings money to the state, some of which is then captured in state taxes. For states with income taxes, increasing the minimum wage will increase state income tax revenue received from some families. And, a state minimum wage will decrease some workers’ eligibility for other means-tested state programs (e.g., Medicaid), and so save a state money on program expenditures. |