REPEALING THE ALTERNATIVE MINIMUM TAX WITHOUT OFFSETTING

THE COST WOULD ADD $1.2 TRILLION TO THE FEDERAL DEBT OVER THE NEXT DECADE

by James Horney

PDF of full report If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader.

Summary

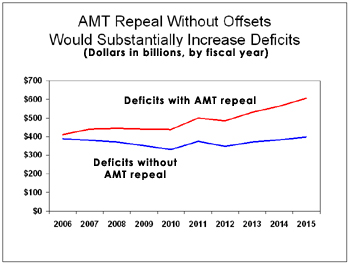

Some Members of Congress — including the Chairman and ranking minority member of the Senate Finance Committee, the Senate Majority Leader, and four other Finance Committee members — introduced legislation in late May that would repeal the individual Alternative Minimum Tax. The legislation does not include measures to offset the cost of repeal. Most tax experts agree that some changes are needed in the AMT. Repealing it without offsets, however, would add nearly $1.2 trillion to deficits and the federal debt over the next decade, assuming the 2001 and 2003 tax cuts are made permanent.

Federal deficits already are projected to total $3.7 trillion over the next 10 years without any change in the AMT and to grow at an accelerating rate in years after that, as increasing numbers of baby boomers retire. If the AMT is repealed without the cost being offset, projected deficits will total nearly $5 trillion over the next ten years, and the federal debt, which is expected to be $4.7 trillion at the end of 2005, will swell to a projected $9.6 trillion by the end of 2015.

Lawmakers should be taking steps to raise revenues and constrain spending

to bring down these unsustainable deficits, not enacting laws that will make

the short- and long-term fiscal situation markedly worse (and overwhelmingly

benefit taxpayers with well-above-average incomes). Policymakers should

consider alternatives to AMT repeal that would minimize the effects of the AMT

on average taxpayers at a cost much lower than the cost of repeal, and they

should pay for whatever reforms are enacted.

Lawmakers should be taking steps to raise revenues and constrain spending

to bring down these unsustainable deficits, not enacting laws that will make

the short- and long-term fiscal situation markedly worse (and overwhelmingly

benefit taxpayers with well-above-average incomes). Policymakers should

consider alternatives to AMT repeal that would minimize the effects of the AMT

on average taxpayers at a cost much lower than the cost of repeal, and they

should pay for whatever reforms are enacted.

The Administration apparently agrees that changes in the AMT should not add to the deficit. The President has instructed his Advisory Panel on Federal Tax Reform to include options for AMT reform in the proposals it will submit to him later this summer, and he has told the panel that the proposals it submits should be revenue neutral (except that they should assume a level of revenues consistent with the 2001 and 2003 tax cuts being made permanent without being paid for). At a recent Congressional hearing, the Deputy Assistant Secretary of the Treasury for Tax Analysis stated, “budgetary constraints preclude simple AMT repeal.”

Lawmakers cannot legitimately claim that they must deal with the AMT without regard to the cost because of the AMT’s impending encroachment upon the middle class. The growing impact of the AMT on middle-income taxpayers was quite well known to lawmakers when they considered the President’s proposed tax cuts in 2001 and 2003. Lawmakers also were well aware that enactment of those tax cuts would greatly increase the number of middle-income taxpayers subject to the AMT. But Congress and the President chose to put off permanent AMT relief in order to maximize the size of the regular income tax cuts that could be enacted within the tax-cut limits set by the Congressional budget resolutions in those years.[1]

Effects of the Alternative Minimum Tax

One matter that virtually all tax experts agree on is that, without a change in law, the AMT will have a substantial effect on growing numbers of middle-income taxpayers in the years ahead. The AMT, established in 1969, was intended to prevent a modest number of high-income Americans from taking advantage of special tax breaks to such an extent that they paid little or no income taxes in some years. Taxpayers who might be subject to the AMT must calculate their tax liability under both the regular income tax and the AMT. They then pay the higher of the two amounts. (See the box on page 8 for a description on how the AMT works.)Only about 3.5 million taxpayers (fewer than 3 percent of all tax filers) will be affected by the AMT this year. Under current law, however, about 30 million taxpayers — 23 percent of all tax filers — will be affected by the AMT by 2010. [2] In addition, millions more will find that filing income taxes has become more complicated because they have to carry out additional calculations to determine that they do not owe an additional amount under the AMT.

This increase in the AMT’s reach is largely due to two factors. First, two key parameters of the AMT — a major income exclusion and the AMT tax brackets — are not indexed for inflation. Second, the 2001 and 2003 tax cuts were structured in a way that will cause millions of additional taxpayers to be subject to the AMT in the years ahead.

Looking out to 2010, taxpayers with incomes below $50,000 (in 2005 dollars) will remain largely unaffected by the AMT in that year. But the Congressional Budget Office estimates that approximately two-thirds of the 26 million taxpayers with adjusted gross incomes between $50,000 and $100,000 will be subject to the AMT in 2010.[3] CBO also estimates that more than 85 percent of taxpayers with incomes between $100,000 and $500,000 a year will be affected by the AMT that year.

The story is different for those with extremely high incomes. Because the top marginal rate under the regular income tax (which is 35 percent) significantly exceeds the highest tax rate under the AMT (which is 28 percent), CBO estimates that more than two-thirds of taxpayers with incomes greater than $500,000 will not be affected by the AMT. Their liability under the regular income tax will continue to exceed their liability under the AMT.

Despite the increasing numbers of middle-income taxpayers who will be affected by the AMT, the overwhelming majority of the revenues the AMT is slated to raise will continue to come from people with well-above-average incomes. According to the Urban Institute-Brookings Institution Tax Policy Center, 89 percent of the tax revenues the AMT will produce in 2010 will be paid by taxpayers with incomes above $100,000, even though only 16 percent of all taxpayers will have incomes that high.

The effect of the AMT varies not only by taxpayer income but also by family size and state of residence. Larger families are more likely to be affected by the AMT, because the AMT does not allow personal exemptions, which substantially reduce taxable income for large families under the regular income tax.[4] In addition, taxpayers in states with higher-than-average state and local income taxes are more likely to be affected because those taxes can be deducted from income under the regular income tax but not under the AMT. These differences between the regular income tax and the AMT, as well as the sheer number of taxpayers who will be affected by the AMT and the AMT’s complexity, have prompted calls for substantial changes in it.

The Cost of Repealing the AMT

While reforms in the AMT are needed, repealing the AMT would pose a substantial problem, as it would be extremely expensive.

- According to the Congressional Budget Office and the Joint Committee on Taxation, repeal of the AMT would reduce federal revenues by $611 billion over the next ten years (2006 through 2015).

- If that revenue loss is not offset, the interest payments on the additional debt that would be incurred would total $179 billion over ten years, driving the total cost of repeal up to $790 billion.

Moreover, these estimates assume that the President’s 2001 and 2003 tax cuts will expire in 2010, as scheduled under current law. That is unlikely to occur. If the 2001 and 2003 tax cuts are extended, the cost of repealing the AMT becomes much higher.[5]

-

There would be an additional revenue loss of $343 billion over ten years, bringing the total reduction in revenues resulting from AMT repeal to $954 billion.[6]

- When the added interest on the debt is included, the total cost of repeal climbs to nearly $1.2 trillion over ten years.

There are alternatives to repeal that would greatly reduce the impact of the AMT on middle-income taxpayers at a substantially lower cost than repeal. For instance, simply indexing the current AMT income exclusion and other parameters for inflation would reduce the number of AMT taxpayers in 2010 by 82.5 percent overall and by 98 percent for taxpayers with incomes between $50,000 and $75,000.[7] Indexing would still be quite expensive, but it would cost significantly less than repeal. CBO estimates that indexing starting in 2007 would reduce revenues by $385 billion over ten years, assuming the 2001 and 2003 tax cuts are not extended. If the tax cuts are extended, indexing would reduce revenues by about $630 billion over ten years. (Taking into account the increased interest payments, indexing would increase deficits by $758 billion over ten years if the tax cuts are extended, or about $400 billion less than repeal would cost.)

The Grim Fiscal Outlook and Why Changes in the AMT Need to be Paid For

Under current policies, the federal budget will continue to run large deficits throughout the next ten years and deficits are projected to begin growing at an accelerating pace after that, as larger numbers of baby boomers retire and health care costs continue to rise faster than the economy. CBO’s most recent baseline budget projections show modest surpluses developing in 2012,[8] but this is because CBO follows baseline rules that require it to assume that the President’s 2001 and 2003 tax cuts will expire in 2010, as provided under current law, and that there will be no further funding for operations in Iraq and Afghanistan after September 30, 2005. When the costs of extending the tax cuts, funding the defense buildup proposed in the President’s fiscal year 2006 budget, and providing funds for ongoing operations in Iraq and Afghanistan (at a level that assumes a phasedown of U.S. activities in those countries) are incorporated into the CBO estimates, large deficits are projected in every year of the coming decade. Projected deficits total $3.7 trillion over ten years. In 2015 (the tenth year), the deficit would be $398 billion.

After 2015, the fiscal situation will only get worse. CBO has noted, “After 2015, if the growth of health care costs continues to exceed that of the economy, outlays for Social Security, Medicare and Medicaid will claim an even larger share of federal spending as the percentage of the population age 65 or older continues to rise….Thus, over the long term, the increasing resources needed for such programs will exert pressure on the federal budget that will make current fiscal policy unsustainable.”[9]

These disturbing projections of deficits over the next ten years assume no change in current AMT law. Thus, repealing or modifying the AMT would add significantly to these already-large deficits.

- As noted, repealing the AMT would reduce revenues by $954 billion over the next ten years, assuming that the 2001 and 2003 tax cuts are extended beyond 2010. Taking into account the interest payments on the additional borrowing that would be necessitated by the lost revenues, deficits would increase by nearly $1.2 trillion in 2006 through 2015.

- This would bring total deficits to nearly $4.9 trillion over the next 10 years.

- Moreover, the national debt (i.e., the “debt held by the public”) would rise from $4.7 trillion at the end of 2005 to $9.6 trillion by the end of 2015.[10] Nearly one-fourth of this increase in the debt would be caused by repeal of the AMT.

Despite the effect that repealing the AMT without offsetting the costs would have on deficits and the debt, some lawmakers apparently feel no need to pay for AMT changes. A bill (S. 1103) introduced in the Senate on May 23 by eight members of the Finance Committee (and one Senator who is not on the Finance Committee), including the Senate Majority Leader and the Chairman and Ranking Democrat of the Finance Committee, would repeal the AMT. The bill does not include offsetting savings.

When asked about whether the cost of repealing the AMT should be offset, one of the bill’s sponsors, Senator John Kyl (R-AZ), told a reporter that “Revenue neutrality is not part of my lexicon.”[11] Finance Committee Chairman Charles Grassley (R-IA) released a statement saying it should not be necessary to offset the cost of extending the AMT relief provided under current law (which is scheduled to expire at the end of 2005), and Grassley told Larry Kudlow on CNBC that “I think it’s very easy to get 60 votes for doing away with the AMT.”

Senator Max Baucus (D-MT), the ranking Democrat on the Finance Committee, indicated to a reporter that at least a “portion” of the AMT repeal should be offset. He also stated, “I just think it’s more important to repeal the AMT.”[12]

Repealing or reforming the AMT without offsetting the cost appears to be at odds with the position of the Bush Administration. Robert Carroll, the Deputy Assistant Secretary of Treasury for Tax Analysis, told the Senate Finance Committee on May 23 that “budgetary constraints preclude simple AMT repeal.”[13] The Administration has proposed instead that AMT reform be part of a package of reforms to be proposed this summer by the President’s Advisory Panel on Federal Tax Reform. The President has instructed that panel to propose reforms that are revenue neutral (except that the Panel is to assume that the 2001 and 2003 tax cuts will be made permanent without any offsets). In other words, the Administration has concluded that AMT reform should be paid for.

The AMT Problem is Not Unanticipated

That the AMT will hit a growing number of middle-income taxpayers in the years ahead comes as no surprise. Lawmakers have long been aware of this problem but have chosen to avoid dealing with it. Instead, they have knowingly enacted cuts in the regular income tax that greatly exacerbated the AMT problem.

The extent of the problem was certainly clear to lawmakers when they considered President Bush’s tax-cut proposals in 2001.[14] The Joint Committee on Taxation (JCT) provided estimates to the Congress in the spring of 2001 showing that the number of taxpayers affected by the AMT would grow to 17.5 million in 2010 if there were no changes in tax laws. JCT also clearly indicated the extent to which enactment of the President’s proposed tax cuts would magnify the problem with the AMT; JCT estimated in early 2001 that enactment of the President’s tax cuts would nearly double the number of taxpayers subject to the AMT, raising it to 30.2 million taxpayers by 2010.[15]

Lawmakers failed to address the looming problems with the AMT not because they were unaware of those problems, but because they wanted to maximize the size of the regular income tax cuts they were enacting. They assumed they would be able to come back in subsequent years, as the AMT began to affect more taxpayers, and pass AMT relief on top of the other tax cuts.

The Congressional budget resolution adopted in 2001 allowed for a tax cut of up to $1.35 trillion for the ten years from 2002 through 2011. In the absence of the President’s tax cuts, adjusting the AMT so the percentage of taxpayers it affected would not increase substantially in the years ahead would have cost $60 billion to $80 billion over that ten-year period.[16] Congress chose instead, however, to provide relief from the AMT only through 2004, at the very small cost of $14 billion.

This had two results. First, it directly made room in the 2001 tax-cut bill for an additional $50 billion or so in other tax cuts. Second, and much more importantly, it sharply reduced the official cost estimate of the income tax cuts that were included in the 2001 tax-cut legislation, because the Joint Tax Committee (which does the official cost estimates) had to assume that, in the absence of any AMT relief after 2004, the AMT would mushroom in size after 2004 and claw back a substantial portion of the bill’s income tax cuts. For example, the Joint Tax Committee estimated that the version of the President’s tax cuts that the House of Representatives passed in early 2001 (H.R. 3) would have cost $292 billion more than the Joint Committee’s official cost estimate, were it not for the assumption the Joint Committee had to make that a swollen AMT would cancel out a substantial portion of those tax cuts.

|

How the AMT Works To determine whether money is owed under the AMT, taxpayers who might be affected by it must calculate their tax liability twice — once under the regular income tax rules and again under the AMT rules. They pay the higher of the two tax liabilities. The AMT differs from the regular income tax in several ways. One is in the items that reduce taxable income. For instance, taxable income under the regular income tax can be reduced by personal exemptions (in 2005, $3,200 for each family member) and by deductions — either the standard deduction or itemized deductions for certain expenses, such as state and local income taxes paid. Such items do not reduce income for purposes of the AMT. Instead, under the AMT, taxable income is reduced by a large overall exemption amount, currently $58,000 for married couples and $40,250 for single taxpayers. In addition, taxable income is taxed at different rates under the AMT than the rates that are applied under the regular income tax: the AMT tax rate is 26 percent on the first $175,000 of taxable income above the exemption and 28 percent on income above that level. The AMT also differs from the regular income tax in that the exemption amounts and the rate brackets are not indexed for inflation. This is one of the two principal reasons for the increase over time in the number and percentage of taxpayers who are affected by the AMT. The other reason is the enactment of legislation in 2001 and 2003 that substantially reduced taxes under the regular income tax without making corresponding adjustments (except on a temporary basis) in the AMT. |

Indeed, the Joint Tax Committee subsequently estimated that if no further action were taken on the AMT, the tax cuts actually enacted in 2001 would raise the number of taxpayers subject to the AMT to a whopping 35.5 million in 2010, as compared to the 17.5 million taxpayers who would have been subject to the AMT in that year if the 2001 tax cuts had not been enacted.[17] The 2001 tax cut greatly increased the number of taxpayers who would fall prey to the AMT because it reduced taxpayers’ liabilities under the regular income tax without making corresponding adjustments in the AMT. Because the 2001 tax cut was structured in this manner, it greatly increased the number of people who will owe more under the AMT than under the regular income tax and thus will become subject to the AMT.

In short, by refusing to include AMT relief (beyond 2004) in the 2001 tax-cut bill, lawmakers were able to squeeze a total of about $350 billion more in regular income tax cuts into that legislation without breaching the $1.35 trillion tax-cut ceiling set for that bill.[18] House Ways and Means Committee Chairman Bill Thomas essentially acknowledged in 2001 that by using maneuvers such as failing to provide AMT relief beyond 2004, phasing in some of the tax cuts, and sunsetting the entire bill in 2010 — all of which artificially lowered the official cost estimate for the bill — he was able to pack more tax cuts into the bill. Thomas referred to his task as squeezing “a pound and a half of sugar into a one pound bag.”[19]

The President and Congress enacted additional tax-cut bills in 2003 and 2004. In those tax bills, as well, Congress employed the same gimmick — it extended AMT relief for just one more year, through 2005. Once again, the decision to put off permanent AMT reform (along with the decision to sunset the dividend and capital gains tax cuts at the end of 2008) allowed lawmakers to squeeze more tax cuts into these bills without appearing to breach the tax-cut ceiling the Congressional budget had set. Although the 2003 tax bill was officially scored as costing $350 billion over ten years, House Speaker Dennis Hastert frankly admitted the cost estimate had been gamed. Hastert said: “The $350 [billion] number takes us through the next two years, basically. But also it could end up being a trillion-dollar bill, because this stuff is extendable.”[20]

Altogether, the AMT maneuvers that were employed in the 2001 and 2003 tax-cut bills had a large effect in camouflaging the true dimensions of the revenue losses those bills will engender. The Tax Policy Center now estimates that if AMT relief were actually allowed to expire on schedule at the end of 2005, the AMT would, by 2010, cancel out 29 percent of the regular income tax cuts enacted in 2001 and 2003. For taxpayers with incomes between $200,000 and $500,000, the AMT would cancel out a stunning 71 percent of the tax cuts.[21]

Of course, as is now abundantly clear, the President and Congressional supporters of the 2001 and 2003 tax cuts never intended to allow the AMT to affect an increasing number of taxpayers and to cancel out a growing portion of the tax cuts. The plan always was to come back and shrink, or eliminate, the AMT at a later time. Indeed, in 2001 and 2003, whenever the President or Congressional supporters of the tax cuts described the benefits of their tax cuts for illustrative families, they ignored the effect that the AMT would have in reducing the tax cuts for many of those families. They sought to have it both ways: they kept the official cost estimate of the tax-cut bills artificially low by designing the bills so that the cost estimates would be based on the assumption that the AMT would cancel out a substantial portion of the tax cuts, while simultaneously promoting the tax cuts to the public by describing the full tax cuts that taxpayers would receive if none of the tax cuts were cancelled out.

Now some of these same lawmakers talk indignantly about the fact that the AMT will affect increasing numbers of taxpayers and offset a significant portion of the regular income tax cuts that taxpayers were told they had been given. (This brings to mind the scene in the movie Casablanca, where Captain Reynaud, the police prefect, professes to be “shocked” to discover that gambling is going on at Rick’s as he pockets his winnings from the roulette table.) They argue that the situation is so intolerable that the AMT must be repealed, regardless of the effect on federal deficits and debt.

Lawmakers clearly were determined to extract the maximum amount of tax cuts in the regular income tax out of the amounts allotted for tax cuts in the 2001, 2003, and 2004 budgets, without regard to the eventual need to make changes in the AMT. These conscious decisions to delay dealing with the AMT makes a mockery of the claim that Congress now confronts a need to push through repeal or a major scaling back of the AMT without regard to the fiscal impact of doing so.

After several years of tax cuts that have substantially increased federal deficits and debt and overwhelmingly benefited higher-income taxpayers — all the while ignoring the need for AMT reform — it would be highly inappropriate to repeal or reform the AMT without offsetting the cost. Doing so would further swell deficits and debt in order to provide further tax cuts primarily for taxpayers with well-above-average incomes.

[1] As explained below, by putting off permanent AMT reform, policymakers crafting the 2001 and 2003 tax cuts both avoided being charged for the cost of AMT reform and substantially lowered the “scored” cost of the President’s tax cuts. This made room in the 2001 tax legislation for about $350 billion in additional tax cuts over ten years.

[2] Len Burman, “The Individual Alternative Minimum Tax,” Testimony before the Subcommittee on Taxation and IRS Oversight of the Senate Committee on Finance, May 23, 2005.

[3] Congressional Budget Office Director Douglas Holtz-Eakin, “The Individual Alternative Minimum Tax,” Testimony before the Subcommittee on Taxation and IRS Oversight of the Senate Committee on Finance, May 23, 2005.

[4] For a couple with six children, personal exemptions of $3,200 a person would reduce taxable income under the regular income tax by $25,600 in 2005.

[5] Since taxpayers pay the higher of their tax liability under the AMT or the regular income tax, cuts in the regular income tax that are not accompanied by changes in the AMT increase the number of people affected by the AMT.

[6] The cost of repeal under the assumption that the 2001 and 2003 tax cuts are extended is estimated by CBPP, based on CBO’s January 2005 estimate of the cost of indexing the AMT income exemption if the tax cuts are extended and on the Tax Policy Center’s estimate of the effect that extension of the tax cuts would have on the costs of indexing the AMT exemption and of full AMT repeal.

[7] Len Burman, “The Individual Alternative Minimum Tax,” p. 11.

[8] Congressional Budget Office, “An Analysis of the President’s Budgetary Proposals for Fiscal Year 2006,” March 2005.

[9] Congressional Budget Office, “The Budget and Economic Outlook: Fiscal Years 2006 to 2015,” January 2005, pp. xiii-xiv.

[10] This would represent an increase in the debt from 38 percent of GDP at the end of 2005 to 49 percent of GDP by the end of 2015.

[11] Heidi Glenn, “Grassley, Baucus Introduce AMT Repeal Bill,” Tax Notes, May 24, 2005.

[12] Heidi Glenn, “Grassley, Baucus Introduce AMT Repeal Bill.”

[13] Page 4 of Dr. Carroll’s testimony.

[14] The President’s budget for fiscal year 2002 proposed only a minor one-year change in the AMT.

[15] Joint Committee on Taxation, “Estimated Revenue Effects of the President’s Fiscal Year 2002 Budget Proposal,” JCX-31-01, May 4, 2001. The AMT problem also was specifically addressed in testimony at a February 2001 hearing on the President’s tax proposals held by the House Ways and Means Committee. See the February 13, 2001, testimony of Robert Greenstein, Executive Director of the Center on Budget and Policy Priorities (pp. 2-3).

[16] CBPP estimate based on a March 2000 JCT estimate (JCS-2-00) of the cost of indexing the AMT exemption and various JCT and CBO estimates of the cost of allowing personal credits to be deducted under the AMT.

[17] See JCT, “Estimated Revenue Effects of the Conference Agreement for H.R. 1836,” (JCX-51-01), May 26, 2001. This number differs from the JCT estimate cited above that 30.2 million taxpayers would be subject to the AMT in 2010 if the President’s tax-cut proposals were enacted because the tax cuts ultimately adopted in 2001 differed in some respects from those the President had proposed

[18] The $350 billion figure consists of the $292 billion reduction in the official cost estimate for the bill that was achieved by assuming that the AMT would partially cancel out the tax cuts, and the $50 billion or more of added room created in the bill by omitting the costs of AMT relief after 2004.

[19] Representative William Thomas, “News Conference with Representative Bill Thomas, Chairman of the House Ways and Means Committee,” Federal News Service Transcript, March 15, 2001.

[20] Mark Wegner and Richard Cohen, “Hastert Salutes ‘Trillion-Dollar’ Tax Bill, Looks to Medicare Debate,” Congress Daily AM, May 23, 2003.

[21] Tax Policy Center Table T05-0076, available at: http://www.taxpolicycenter.org