|

June 7, 2006

ESTATE TAX REPEAL — OR SLASHING THE ESTATE TAX RATE — WOULD SUBSTANTIALLY REDUCE CHARITABLE GIVING

By Aviva Aron-Dine

Repealing the estate tax would substantially reduce U.S. charitable giving, according to research by the Congressional Budget Office and various economists. As CBO’s study explains, the estate tax creates powerful incentives for affluent individuals to donate to charity. Since donations made both during life and at death reduce the size of an estate and thus the amount subject to the estate tax, the tax encourages both bequests at death and charitable contributions made during life. Not surprisingly, both CBO’s study and other analyses have found that repeal of the estate tax would have a large negative impact on charities.

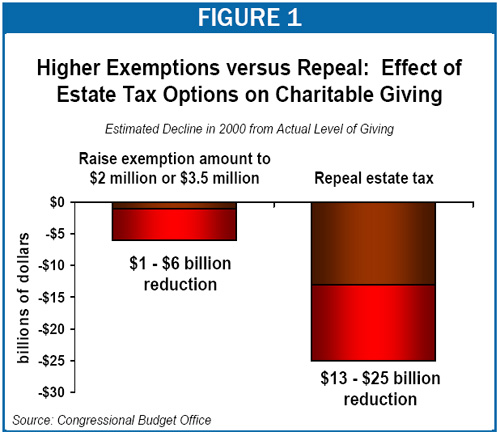

- CBO estimated that, had the estate tax not existed in 2000, charitable donations would have been $13 billion to $25 billion lower that year. CBO found that repealing the estate tax would have reduced charitable bequests by 16 to 28 percent and charitable giving during life by 6 to 11 percent.[1]

- The amount by which CBO found that charitable donations would have fallen in 2000 exceeds the total amount of corporate charitable donations in the United States in that year (which equaled $11 billion) and approaches the total amount that foundations contributed to charitable causes ($25 billion).

- A study by Brookings Institution economists Jon Bakija and William Gale found effects of similar magnitude, as have analyses by various other researchers.[2]

Based on this body of research, a report on the estate tax issued by the Urban Institute-Brookings Institution Tax Policy Center concluded that “repeal would be devastating” for charitable giving.

Kyl Proposal to Cut Estate Tax Rate to 15 Percent Also Would Reduce Giving

Estate tax proposals that would slash the tax rate — such as a proposal by Senator Jon Kyl that would reduce the rate to 15 percent — would be almost as detrimental to charitable giving as repealing the estate tax altogether. At the tax rates in effect through 2009, the estate tax serves as a strong incentive for giving because it makes charitable donations far cheaper than they otherwise would be.[3] For example, if taxable assets are subject to the estate tax at a 45 percent rate, then a charitable donation of $100 costs only $55, because the other $45 would otherwise have been paid in estate tax. In contrast, with a 15 percent estate tax rate, as proposed by Senator Kyl, a $100 donation would cost $85. For this reason, economist William Gale has testified to the Senate Finance Committee that “reducing the top estate tax rate would have a significantly negative effect” on charitable giving.[4]

In contrast, the Congressional Budget Office found that reforming the estate tax by increasing the exemption level in effect in 2000 to as much as $3.5 million per individual ($7 million per couple) — the exemption level that will exist under current law in 2009 — would have only a relatively modest impact on giving (see Figure 1). Because the largest donations are generally made by the largest estates, exempting smaller estates from tax would reduce charitable giving by only a fraction of the amount that giving would be reduced by full repeal or by drastic reductions in the estate-tax rate.

End Notes:

[1] Congressional Budget Office, The Estate Tax and Charitable Giving, July 2004. The CBO report is discussed in more detail in David Kamin, “New CBO Study Find that Estate Tax Repeal Would Substantially Reduce Charitable Giving,” Center on Budget and Policy Priorities, August 3, 2004, https://www.cbpp.org/8-3-04tax.htm.

[2] Jon Bakija and William Gale, “Effects of Estate Tax Reform on Charitable Giving,” Tax Notes, Jun 23, 2003. The article also discusses similar findings by Duke University Professors Charles Clotfelter and Richard Schmalbeck and Treasury Department economists Gerald Auten and David Joulfaian.

[3] The top estate tax rate, which was 55 percent under pre-2001 law, is 46 percent in 2006 and will be 45 percent in 2007 through 2009. The estate tax is repealed for one year in 2010 and then comes back into effect in 2011 at the rates and exemption levels in effect under pre-2001 law.

[4] William Gale, “Charitable Giving and the Taxation of Estates,” Testimony Submitted to the United States Committee on Finance, September 13, 2005. |