SENATE CHILD TAX CREDIT MORE

ADVANTAGEOUS FOR 16.5 MILLION CHILDREN THAN HOUSE VERSION

Differences Especially Dramatic for Children in Hispanic and Black Working Families

by Allen Dupree

and Wendell Primus

| View PDF version If you cannot access the file through the link, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

Some 7.6 million low-and moderate-income working families — and 16.5 million children in these families — would fare better under the Senate child credit provision than the House provision when these provisions are fully in effect. No families and children would fare better under the House provision. These figures, which are based on Census data, include both families and children who would benefit from the Senate child credit provision but not the House provision and families and children who would benefit from the child credit expansions in both bills but would benefit to a greater degree from the Senate provision.

Overall, 23 percent of all children in the United States — nearly one in four — would fare better under the Senate child credit provision. Some 40 percent of Hispanic children — two of every five — would do better under the Senate provision. Among black children, 31 percent — nearly one in three — would fare better under the Senate provision. All of the children that would fare better under the Senate bill live in working families. (Among families, 20 percent of all families with children would fare better under the Senate provision.)

(Reflects Child Credit Provisions When Phased in Fully) |

||||

Overall |

White |

Black |

Hispanic |

|

Number of Children (in millions) |

16.5 |

7.5 |

3.4 |

4.7 |

Percentage of Children |

23% |

17% |

31% |

40% |

Number of Families (in millions) |

7.6 |

3.8 |

1.6 |

2.0 |

Percentage of Families with Children |

20% |

15% |

27% |

35% |

Average Amount by Which Senate Credit Exceeds House Credit, Per Family (in 1999 dollars) |

$868 |

$884 |

$793 |

$890 |

| Source: CBPP tabulations of the March 2000 Current Population Survey. | ||||

The 7.6 million families with children that would benefit more from the Senate child credit provision would receive an average of $868 more under the Senate child care provision when the provisions of both bills are phased in fully.

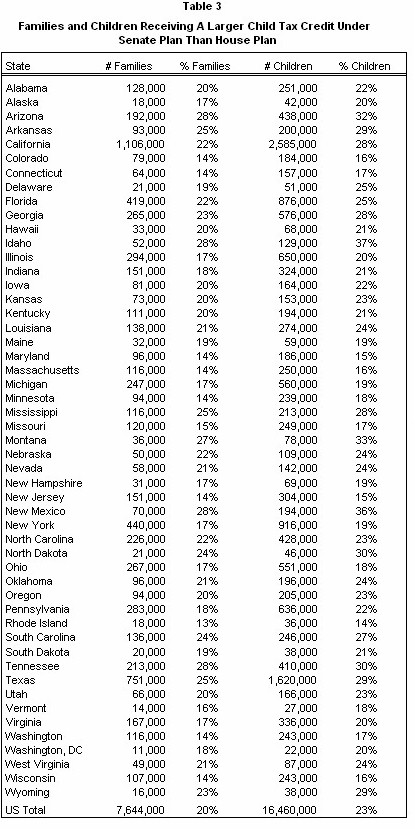

The children who would fare better under the Senate than the House child credit provision are found in large numbers in virtually every state. The number of children who would fare better under the Senate provision exceeds 100,000 in 38 states. In 18 states, the number who would fare better under the Senate provision equals or exceeds a quarter million children. These 18 states are Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Louisiana, Massachusetts, Michigan, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Texas, and Virginia. Tables 3 and 4, at the end of this report, provide data for all states.

These differences stem from the different structures of the child credit proposals in the two bills. Working families would become eligible to receive a partial child tax credit under the Senate plan when their earnings surpassed $10,000, about what full-time minimum-wage work pays. Under the House bill, most families would not begin to benefit from the child tax credit expansion until their earnings reached levels more than twice that high.

Families and Children that Would

Benefit From the Senate Provision

But Be Entirely Left out of House Provision

|

|||||||||||||||||||||

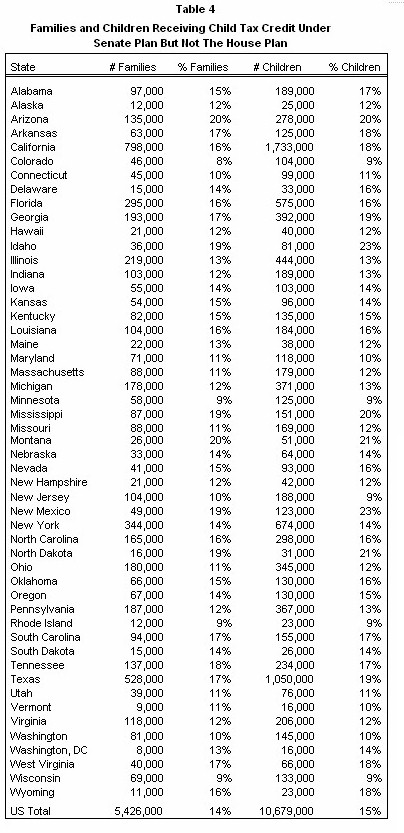

The Senate provision would assist 5.4 million working families — and 10.7 million children in these families — that would receive no benefit from the House child credit provision. One in every seven families with children would benefit from the Senate provision but receive nothing from the House provision.

The 10.7 million children in low-income working families that would benefit from the Senate but not the House child credit provision include 4.6 million non-Hispanic white children, 3.1 million Hispanic children, and 2.4 million black children.

Families and Children that Would

Benefit From the Child Credit Provisions of Both Bills,

But Benefit More From the Senate Approach

A substantial number of families and children would benefit from both provisions but receive a larger child credit under the Senate than the House bill. (Many low- and moderate-income families would receive a partial child credit under both bills — that is, a credit smaller than the maximum credit per child.) Some 2.2 million families and 5.8 million children who would benefit from the child credit expansions of both bills would receive a larger child tax credit under the Senate plan.

Differences Between the Bills Especially Stark for Full-Time Working Families

The number of low-income families with a full-time working parent that would be entirely left out of the House child credit expansion is quite large — 4.3 million. By comparison, 700,000 such families would not benefit from the Senate provision. In other words, the number of full-time working families with children that would not benefit from the child credit expansion is more than six times larger under the House bill than under the Senate bill. |

||||||

The Total Number Who Would Fare Better Under the Senate Provision

A total of 7.6 million low- and moderate-income working families and 16.5 million children in those families would receive a larger child credit from the Senate than the House plan. These totals include families and children that would benefit from the Senate but not the House provision and families and children that would benefit from both provisions but benefit more from the Senate approach.

For the families receiving a larger benefit from the Senate plan, the additional credit would average almost $870. For affected Hispanic families, the average credit would be $890 greater under the Senate bill. It would be $880 more for affected white families and $790 more for affected black families. Overall, nearly 70 percent of the families receiving a greater benefit under the Senate proposal would receive at least a $500 larger child credit under that proposal.

Conclusion

As this analysis indicates, millions of working families and their children would fare better under the Senate plan to expand the child tax credit. Many of these families would receive no benefit from any other element of the Senate Finance or House tax proposals. The child credit provisions of the Senate bill would make a significant contribution to reducing child poverty and improving the well-being of near-poor working families with children.