THE IMPACT OF THE PRESIDENT'S PROPOSAL

ON SOCIAL SECURITY SOLVENCY AND THE BUDGET

by Jason Furman

PDF of full report If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader.

The President has announced two parts of his Social Security plan. In his State of the Union Address on February 2, he proposed private accounts, to be paid for by reductions in traditional Social Security benefits. In an April 28 press conference, the President announced sliding-scale benefit reductions modeled on a plan proposed by investment executive Robert Pozen.

In July, in conjunction with the release of its mid-year budget estimates, the Administration made a minor revision in its plan, slightly lowering the amount by which the Social Security benefits of people choosing private accounts would be reduced. This analysis updates the analysis of the President’s proposal that the Center on Budget and Policy Priorities issued on May 10 in order to reflect this modification of the proposal.

Unfortunately, the White House has not released the traditional 75-year analysis by the Social Security actuaries of the effect of its plan on Social Security solvency. It is standard practice for policymakers and outside analysts who present Social Security plans to provide the actuaries’ analysis when, or shortly after, they release their plans. In the absence of an analysis by the Social Security actuaries, this analysis provides some of the standard actuarial and fiscal estimates of the President’s proposal.[1] The analysis is based on the actuaries’ analysis of the Pozen proposal, which has been released, analyses by the actuaries of other private-account plans that contain features similar to those of the President’s plan, analysis by the actuaries of the President’s private accounts through 2015, and the data in the 2005 Social Security trustees report. (For further detail on how this analysis was conducted, see the appendix.)

Summary Measures of the Effect of the President’s Plan on Social Security Solvency

Table 1 shows four basic measures of the impact of the President’s plan on Social Security finances and the program’s solvency.

|

Table 1 - Impact on President’s Plan on Social Security Financing and Solvency |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

The table reflects the following findings:

-

Because the sliding-scale benefit reductions (also called “progressive price indexing”) that the President has proposed would not start until 2012 and would be small initially, this proposal would move back the date when Social Security’s benefit costs will first exceed its tax revenues by only two months, to slightly later in 2017.

-

The sliding-scale benefit reductions would have a somewhat larger effect on the date when Social Security would become insolvent — the benefit reductions would move that date back by six years, from 2041 to 2047.

-

The President’s private accounts, however, would

accelerate the date on which Social Security begins to have a

cash-flow deficit, as well as the date of insolvency, because establishing

the accounts requires diverting large sums from Social Security to the

accounts. When the sliding-scale benefit reductions and the private

accounts are considered together (i.e., when both components of the

President’s plan are examined), the plan is found to move forward the year

in which Social Security would become insolvent from 2041 to 2030. This

result could be averted only by large cash transfers from the Treasury or

additional benefit reductions or tax increases. The plan also would

accelerate the year in which the program begins to run cash-flow deficits

from 2017 to 2011.

The President’s private accounts, however, would

accelerate the date on which Social Security begins to have a

cash-flow deficit, as well as the date of insolvency, because establishing

the accounts requires diverting large sums from Social Security to the

accounts. When the sliding-scale benefit reductions and the private

accounts are considered together (i.e., when both components of the

President’s plan are examined), the plan is found to move forward the year

in which Social Security would become insolvent from 2041 to 2030. This

result could be averted only by large cash transfers from the Treasury or

additional benefit reductions or tax increases. The plan also would

accelerate the year in which the program begins to run cash-flow deficits

from 2017 to 2011.

-

The President’s sliding-scale benefit reductions, by themselves, would close 60 percent of Social Security’s long-term (i.e., 75-year) funding shortfall.[2] (White House statements that the benefit changes would close 70 percent of the cash flow gap are somewhat misleading; they refer to the percentage of the gap that would be closed in a single year — 2079, the 75th year — not to the share of the cumulative 75-year gap that would be closed.)

-

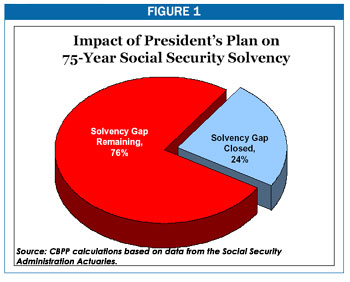

When the private accounts are added in, however, the President’s plan as a whole is found to close only 24 percent of the 75-year gap. More than three-quarters of the gap would remain. Additional benefit reductions, new revenues, or large transfers from the rest of the budget would be necessary to fill the substantial remaining gap.

Effects on Deficits and Debt

Table 2 shows the impact of the President’s plan on federal deficits and the debt. This table shows that the President’s plan, including both the private accounts and the sliding-scale benefit reductions, would add about $5 trillion to the debt (i.e., the “debt held by the public”) over the first 20 years the plan was in effect (from initial implementation of the plan in 2009 through 2028). By 2050, the plan would cause the federal debt to be larger than it otherwise would be by an amount equal to 19 percent of the Gross Domestic Product.

|

Table 2 - Impact of President’s Plan on Federal Deficits and Debt |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

Unified budget deficits would remain higher than they otherwise would be through 2054. The federal debt would be higher than it otherwise would be through 2067.

By contrast, under traditional reform plans like that proposed by economists Peter Diamond and Peter Orszag, the debt would be reduced immediately, and by 2050, the amount of debt reduction would be substantial.

All of these findings are discussed in more detail below.

Analysis by the Social Security Actuaries Would Be Useful

As noted, these findings are based on analysis of similar proposals and plans by the Social Security actuaries. It is unfortunate that the White House has not released an analysis by the actuaries that examines the President’s plan. It would be helpful if such an analysis were conducted and issued as soon as possible.

The White House may contend that it is premature to release an actuaries’ memorandum because the Administration’s plan is not a complete plan. When it serves its purposes, however, the White House has not hesitated to release certain numbers about its plan from what appears to be analysis conducted by the actuaries.

Moreover, there is precedent for releasing analyses by the actuaries of partial Social Security plans. In February, for example, the White House released an analysis by the actuaries of the impact of the President’s private accounts through 2015. The Clinton administration also released several 75-year actuaries’ analyses on incomplete plans, and Robert Pozen has released the actuaries’ analysis of his plan, despite the fact that the plan falls short of fully restoring solvency and Pozen recommends that Congress consider additional benefit reductions or tax increases on top of his sliding-scale benefit reductions.

Solvency Measure #1: The Effect of the Plan on Social Security’s Cash-flow Deficit

In describing what he calls the “crisis” that Social Security faces, the President has emphasized 2017 — the year in which the Social Security Trustees project that Social Security’s tax revenue will start to be insufficient to pay for benefits fully and Social Security will have to start spending some money from the interest on the Trust Fund’s bonds. As discussed in other Center analyses, this date is not a very meaningful measure of Social Security’s ability to pay benefits.[3]

Administration officials and other analysts have featured the onset of a cash-flow deficit in 2017 prominently in their critique of proposals to raise the ceiling on the amount of earnings subject to the payroll tax. White House Social Security Adviser Charles Blahous stated last month, “even if the cap were entirely eliminated, and every penny of wages in America were subject to taxation, the system’s permanent shortfalls could only be postponed by six years (from 2018 to 2024).”[4] Heritage Foundation analyst David John made the same point, arguing that raising the cap, “would only delay the start of Social Security’s annual deficits by six years, from 2018 to 2024.”[5]

| Details of the President’s

Plan The details of the President’s plan used in making the actuarial estimates presented in this paper are as follows:

_______________________ a White House, “Strengthening Social Security for the 21st Century,” February 2005, and Stephen Goss, Chief Actuary, Social Security Administration, “Preliminary Estimated Effects of a Proposal to Phase In Personal Accounts,” February 3, 2005. According to the White House fact sheet, “the cap would gradually rise over time, growing by $100 per year, plus the growth in average wages.” (CBPP’s initial analysis, issued immediately after the President’s State of the Union Address, assumed that the cap on account contribution would increase by $100 a year only until 2015 and would grow only with wage inflation thereafter. It is now clear that the assumption that the cap would cease increasing by $100 a year in 2015 does not reflect the President’s plan, which allows larger accounts than was initially evident.) b Stephen Goss, Chief Actuary, Social Security Administration, “Preliminary Estimated Effects of a Proposal to Phase In Personal Accounts,” July 15, 2005. c White House, “Fact Sheet: Strengthening Social Security for Those In Need,” April 28, 2005, and Social Security Administration, Office of the Chief Actuary, “Estimated Financial Effects of a Comprehensive Social Security Reform Proposal Including Progressive Price Indexing -- INFORMATION,” February 10, 2005. d Social Security disability benefits are automatically converted to retirement benefits at that time. The White House has not specified what will happen to people receiving disability benefits when they reach retirement age. |

Applying this same analysis to the sliding-scale benefit reduction that the White House has endorsed, however, shows that this reduction would delay the onset of Social Security’s cash flow deficit by only about two months. The White House may argue that it is unfair to analyze only one provision of the President’s plan when he is committed to taking further steps (although he has not said what those steps should be). But supporters of raising the ceiling on taxable earnings such as Diamond and Orszag have consistently said, as has the AARP, that this measure, too, should be but one part of a larger set of changes. Either the White House criticism of raising the payroll tax cap applies with even greater force to the benefit reductions that the President himself has proposed or this is a rather meaningless and deceptive criticism of the proposal to raise the payroll tax cap. (The latter is the best way to view this matter. The date of the onset of cash-flow deficits is not a meaningful way to evaluate Social Security’s current challenges or proposals to address those challenges.)

As for the President’s proposal to divert payroll taxes into private accounts, it would move the cash-flow deficit date in the opposite direction. Diverting payroll tax revenue to private accounts would reduce the revenue available to pay Social Security benefits and thereby advance the date when the program’s benefit costs exceed its non-interest income. According to analysis by the Center on Budget and Policy Priorities that updates an analysis that the Social Security actuaries issued earlier this year, combining the benefit reductions the President has proposed with his private accounts would accelerate to 2011 the year in which Social Security’s tax revenues no longer are sufficient to pay benefits and Social Security consequently will have to start using interest on the Trust Fund.[6] This is six years earlier than under current law.

Solvency Measure #2: The Trust Fund Exhaustion Date

Under a Pozen-style benefit-reduction proposal that protects disability benefits and also provides a minimum benefit, as the White House says its plan would do, the Social Security Trust Fund would be exhausted in 2047, only six years later than under current law. (This does not include the effect of the President’s private accounts on the Trust Fund; the effect when the private accounts are added is discussed below.) Benefits would have to be cut about 15 percent after 2047, in addition to the benefit reductions resulting from “progressive price indexing,” unless additional measures to restore solvency were added.

This is significant because it demonstrates a fundamental flaw in recent White House efforts to promote the President’s plan by comparing benefit levels under that plan primarily to the benefits that would be paid if no action were taken and Social Security became insolvent in 2041. In making such comparisons, the White House has compared benefit levels under an approach that closes 100 percent of the shortfall — by cutting benefits enough starting in 2041 to eliminate all of the shortfall — to benefit levels under its plan, which closes only part of the shortfall and which would delay the onset of insolvency by only six years. Consistency (and intellectual honesty) require that in making comparisons of this nature, the same method be applied to the White House proposal for years after 2047 that the White House is applying to benefit levels after 2041 under the “do nothing” scenario. This means assuming that benefits would be reduced another 15 percent after 2047 under the White House plan.

The White House may respond that under its plan, additional steps would be taken to restore solvency. Those additional steps are not incorporated, however, into the White House comparisons of benefit levels under its plan to the benefits that would be paid if solvency were restored fully through cutting benefits starting in 2041. As a result, the White House comparisons are invalid; they compare apples to oranges.

Trust Fund Exhaustion Date Advances with Private Accounts

When the President’s private accounts are added into the equation, the date when the Trust Fund is exhausted is moved forward. This is because the private accounts would drain significant sums from the Trust Fund in the first several decades. Under the combination of the sliding-scale benefit reductions and the private accounts that the President has proposed, the Social Security Trust Fund would be exhausted in 2030. To avoid additional benefit cuts at that time, large general revenue transfers from the Treasury would be required, unless the plan were altered to include additional benefit reductions or revenue increases to restore solvency.

Solvency Measure #3: Closing Social Security’s Actuarial Deficit

Robert Pozen has stated that his “progressive price indexing” proposal would “close the long-term deficit of Social Security by over 70%.”[7] This is consistent with the analysis of the Social Security actuaries, who have analyzed the Pozen plan and found it would close 72 percent of the 75-year deficit.

About one-sixth of the improvement in solvency under the Pozen proposal comes from reductions in disability benefits,[8] which the White House says its plan does not include. A similar amount of the solvency improvement under the Pozen plan is the result of reductions in benefits for survivors, including children who receive benefits as a result of the death of a parent prior to retirement; the White House plan does include those reductions. The remainder comes from reductions in retirement benefits.

The President also has proposed a minimum benefit for poor seniors that would add a further, albeit modest, cost.[9] When the proposal to shield disability benefits and the proposed minimum benefit are coupled with Pozen’s sliding-scale benefit reductions for retirees and survivors, as the White House plan would do, the result is the elimination of 60 percent of Social Security’s 75-year deficit (rather than 70 percent).[10]

Moreover, the President’s Social Security accounts would increase the program’s projected 75-year actuarial deficit by roughly 0.69 percent of payroll. The current deficit is estimated by the actuaries to be 1.92 percent of payroll, so the private accounts, themselves, would increase the size of the 75-year shortfall by more than one-third.

The private accounts would substantially worsen Social Security’s projected shortfall over the next 75 years because the reductions in Social Security benefits for those who elect the accounts, which would be instituted to repay the Trust Fund for the funds diverted to the accounts, would be made with a lag; some of the funds diverted from Social Security to private accounts over the next 75 years would not be repaid until after the end of the 75-year period.

Because the private accounts would increase Social Security’s shortfall over the next 75 years, the net effect of the White House’s sliding-scale benefit reductions and its private accounts would be to close only 24 percent of Social Security’s 75-year shortfall. More than three-quarters of the shortfall would remain.[11] The President’s plan would require general revenue transfers amounting to $3.3 trillion in present value to close this gap.[12]

Solvency Measure #4: The Infinite Horizon Deficit

When the White House released the private-accounts portion of its plan in February, a senior Administration Official told reporters, “in a long-term sense, the personal accounts would have a net neutral effect on the fiscal situation of the Social Security and on the federal government.”[13] This statement turns out, however, to be incorrect; the President’s proposal would worsen solvency even over an “infinite horizon,” although by a smaller percentage than it would worsen solvency over 75 years.

Furthermore, in mid-July, the President’s proposal was modified to lower slightly the amount by which the Social Security benefits of people electing the accounts would be reduced. This change would further worsen solvency.

The accounts would worsen solvency, even over an infinite horizon, for three principal reasons:

- The accounts would be subsidized. Under the President’s revised proposal, payroll tax revenues on which the Social Security Trust Fund would have earned a 3 percent real interest rate would be diverted to private accounts, and the Trust Fund would subsequently be paid back (through Social Security benefit reductions) at a 2.7 percent real interest rate. As a result, Social Security would lose money on the accounts. Essentially, Social Security would be subsidizing the accounts. The cost of that subsidy would make Social Security’s financing shortfall larger.

- The private accounts also would include a new “inheritance benefit.” If an unmarried worker died prior to retirement, his or her entire account would go to his or her estate, and the Social Security system would never be paid back. This also would worsen solvency.

- The Social Security system would not be fully paid back in a number of other cases, as well. For example, as a result of the sliding-scale benefit reductions the President’s plan contains, the Social Security benefits that some higher-income people would be slated to receive would be smaller than the amount by which their Social Security benefits would need to be reduced for the “benefit offset” to be collected. In these cases, their entire Social Security benefit would be eliminated, but the remainder of the debt that they owed to Social Security would go uncollected. That would cause the Social Security Trust Fund to suffer a net loss and would thereby worsen solvency. This problem would arise in the case of all workers receiving steady earnings at or above the payroll tax ceiling (now $90,000 a year) who retired after 2060.[14]

Effect on Deficits and the Debt

The President’s proposals would have a significant impact for the foreseeable future on deficits and the federal debt. According to the Social Security actuaries, the President’s private accounts would cost $723 billion over the first 7 fiscal years (from 2009 to 2015).[15] The number is artificially low, however, because the private accounts would only be available to all workers for the last four of these seven years.[16]

Over longer periods, the effect on the debt would be considerably greater. Over the first 10 years that the plan would be in effect (2009 – 2018), the Administration’s private accounts would add $1.4 trillion to the debt. The accounts would cause the debt to increase by another $3.9 trillion in the decade after that, for a total of $5.3 trillion over the first 20 years.[17]

By contrast, the sliding-scale benefit reductions that the President is proposing would reduce the debt, although by relatively modest amounts in coming decades. Over the first 20 years, those benefit reductions would reduce the debt by $400 billion. Thus, the combined effect of the private accounts and the sliding-scale benefit reductions the White House is proposing would be to add $4.9 trillion to the debt over the first 20 years.

The debt would remain elevated for a number of decades after that. In 2050, the amount by which the debt would be larger, as a result of the President’s Social Security plan, would equal 19 percent of GDP. The increase in the debt that the plan would cause would be equal to about half of the entire federal debt today. The debt would remain higher through 2069 than it would be under current law.

Increases in debt of that magnitude could be perceived by financial markets to be a serious problem, especially if the markets were not convinced that the mounting Social Security benefit reductions scheduled for future decades would, in fact, materialize in full. An increase in debt of this magnitude also would have significant effects on the government’s cash flow.

In contrast, a traditional Social Security solvency plan that includes a balanced mix of benefit reductions and new revenues, as the 1983 Social Security legislation did, and that does not feature private accounts would begin to reduce the debt in its first decade and would continue to do so thereafter. The plan designed by Diamond and Orszag would have that effect. Under such a course, the amount of debt reduction by 2050 would be substantial.

Conclusion

Analysts use a variety of measures to gauge the impact of Social Security reforms on Social Security solvency and the overall fiscal outlook. By any of these measures, borrowing trillions of dollars and draining money from the Social Security trust fund would be worrisome.

The President has laid out part of a plan rather than a full plan. This analysis highlights how much further he needs to go to have a complete plan that fully restores solvency.

APPENDIX

The Estimating Methodology Used In This Paper

Typically, the Social Security actuaries provide an estimate of the financial effects of Social Security proposals over the next 75 years. The White House has not, however, provided sufficient detail to the actuaries to produce such an analysis of its plan. The only official analyses of the plan by the actuaries is a February memorandum, subsequently updated in July, showing the financial impact of the President’s private accounts over just the first seven years that the accounts would be in existence (2009-2015).[18]

This CBPP analysis is based on a series of analyses conducted by the Social Security actuaries. It was produced by combining, and extrapolating from, analyses that the actuaries have conducted of similar Social Security plans, in order to model the financial effects of the President’s plan over the next 75 years.

The Social Security actuaries have published year-by-year estimates for the next 75 years of the effects of Robert Pozen’s “progressive price indexing” proposal.[19] The President’s sliding-scale benefit reduction proposal apparently reduces the Social Security shortfall by about 80 percent as much as the Pozen proposal. The difference is due to the fact that the President’s plan, unlike Mr. Pozen’s, protects disability benefits and adds a minimum benefit, while the Pozen plan does not. We scaled down accordingly the actuaries’ estimates of the financial effects of the Pozen proposal.

The actuaries also have scored two plans with private accounts under which the Trust Fund would be compensated through reductions in the Social Security benefits of those who elect the accounts, with the reductions set equal to the amount that a worker diverted to his or her account, plus an interest charge equal to inflation plus three percent. This is the same offset mechanism that the President’s plan uses. The two such plans that the Social Security actuaries have analyzed are Mr. Pozen’s plan and a plan developed by Senator Chuck Hagel.[20]

The private-account features of those two plans differ in certain respects from the President’s plan, such as with regard to the phasing in of the accounts, the account sizes, and the proposed offset rate. This analysis adjusts the actuaries’ estimates of the costs and benefit offsets associated with the private accounts in those two plans to match as closely as possible the structure of the accounts under the President’s plan. The analysis also draws on a revised analysis that the actuaries conducted of the effects of the President’s private accounts through 2015, which was released on July 15, 2005.

End Notes:

[1] All estimates are consistent with the assumptions in the 2005 Trustees Report.

[2] The Center previously released an estimate that the President’s plan closed 57 percent of the solvency gap. That was based on the 2004 Trustees Report, the report used to score the Pozen plan. All estimates in this analysis are updated to reflect the assumptions in the 2005 Trustees Report.

[3] See Jason Furman, “Does Social Security Face a Crisis in 2018,” January 11, 2005.

[4] Charles Blahous, “Ask the White House,” 4/5/2005, http://www.whitehouse.gov/ask/20050405.html. Scott McClellan made a similar statement in his February 10 briefing: “In terms of raising the wage cap -- or raising the cap, we've pointed out that that issue -- that doing that does not solve the problem -- the fiscal problem facing Social Security, it only pushes the date out a few years.”

[5] David John, “Raising the Social Security Payroll Tax Cap Does Not Fix Social Security,” Heritage Foundation Web Memo #667, February 16, 2005.

[6] See Stephen Goss, Chief Actuary, Social Security Administration, “Preliminary Estimated Effects of a Proposal to Phase In Personal Accounts,” July 15, 2005. This memo estimated that the accounts would cost $92 billion in 2011. This is larger than the $88 billion cash surplus for 2011 projected in the 2005 Trustees report.

[7] Robert Pozen, “Testimony on Progressive Indexing before the Senate Finance Committee,” April 26, 2005.

[8] Based on an estimate by Peter Diamond and Peter Orszag, about one-sixth of the improvement in solvency in the Pozen plan comes from reductions in disability benefits. Diamond and Orszag, “Reducing Benefits and Subsidizing Individual Accounts: An Analysis of the Plans Proposed by the President’s Commission to Strengthen Social Security,” June 2002.

[9] This analysis assumes the President’s minimum-benefit proposal is similar to the minimum benefit proposed by his Social Security Commission.

[10] The White House claims its “reform would solve 70 percent of the funding problems facing Social Security” (see White House Fact Sheet, April 28, 2005). But the White House has subsequently acknowledged that this statement refers to the deficit in the 75th year — 2079 — not to the cumulative deficit over the next 75 years.

Needless to say, that is not the standard measure used to evaluate the effect of a proposal on Social Security solvency. It is, at best, a secondary measure, and one with significant weaknesses. One could design a plan that would not start until 2079, with no changes until that date, but that would eliminate the entire Social Security shortfall in 2079. Such a plan would fail to restore solvency over the 75-year period or to improve the fiscal outlook for the next seven and a half decades.

[11] Some may try to argue that there would be a small cash-flow surplus in 2079 under the plan. This is misleading because it ignores the substantial interest payments that would have to be made, either by the general fund or by the Social Security Trust Fund, on the several trillion dollars that would have to be borrowed to establish the accounts. The interest on the $3.3 trillion in general revenue transfers that would be necessary to establish the accounts and pay benefits through 2079 would be enormous by 2079.

[12] According to the actuaries memo, the Pozen plan would entail $1.9 trillion in general revenue transfers. The transfers under the President’s plan are larger because he is proposing larger accounts (Pozen has two percent accounts), a larger subsidy for the accounts (Pozen has an offset rate of 3 percent above inflation while the President is now proposing an offset rate of 2.7 percent above inflation), and smaller benefit reductions (Pozen’s plan would reduce disability benefits and does not contain a minimum benefit).

[13] Office of the Press Secretary, “Background Press Briefing on Social Security,” February 2, 2005.

[14] For a further discussion of this issue, see Peter Orszag, “Social Security Reform, Testimony Before the Senate Finance Committee,” April 26, 2005.

[15] The actuaries released this estimate on July 15. Previously, the actuaries estimated a 7-year cost of $743 billion.

[16] The accounts would not be available to all workers until 2011 and would not be phased fully in until 2041. That is the year in which the cap on the maximum amount that could be diverted to a private account each year would rise to a high enough level that all workers could contribute a full 4 percent of their taxable earnings to the accounts.

[17] In February, CBPP published two sets of preliminary estimates of the President’s accounts. One estimate showed that the accounts would add $4.9 trillion to the debt over the first 20 years. That estimate was based on the assumption that the maximum allowable account size would not continue to increase by $100 a year (in addition to wage inflation) after 2015. It has since become clear that the White House plan would continue to increase the maximum account size by $100 a year, until everyone could contribute a full four percent of taxable earnings to the accounts. The estimates presented here reflect that feature of the plan.

[18] Stephen Goss, Chief Actuary, Social Security Administration, “Preliminary Estimated Effects of a Proposal to Phase In Personal Accounts,” February 3, 2005 and July 15, 2005.

[19] Social Security Administration, Office of the Chief Actuary, “Estimated Financial Effects of a Comprehensive Social Security Reform Proposal Including Progressive Price Indexing -- INFORMATION,” February 10, 2005..

[20] Social Security Administration, Office of the Chief Actuary, “Estimated Financial Effects of ‘The Saving Social Security Act of 2005,’ March 10, 2005—legislation introduced as S. 540 (109th Congress) by Senator Chuck Hagel,” March 10, 2005.