THE COST OF THE TAX CUT COMPARED WITH THE COSTS OF VARIOUS FEDERAL AGENCIES

| PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

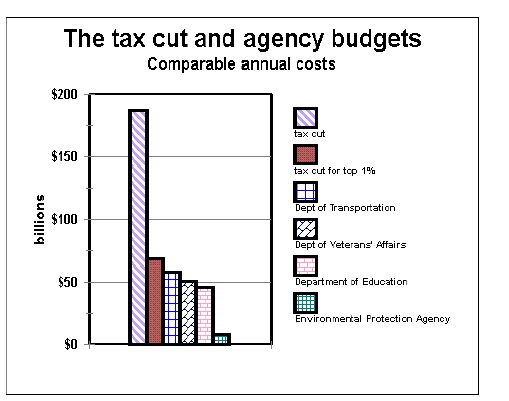

One way to grasp the magnitude of the tax cut when it becomes fully effective — and of the costs of making the tax cut permanent — is to compare the tax cut's cost when it is fully in effect to the costs of various federal agencies.(1) When fully effective, the tax cut will be —

- four times as large as the budget for the entire Department of Education;

- more than three times as large as the Department of Veterans Affairs or the Department of Transportation; and

- twenty-four times the size of the Environmental Protection Agency.

The tax cut is skewed to those with the highest incomes. (The degree to which the tax cut favors the well off may not yet be readily apparent because the aspects of it that are already in effect tend to be the most progressive while the aspects not yet in effect are, overall, highly regressive.) When the entire tax cut is fully in effect, the tax cuts conferred on the one percent of taxpayers with the highest incomes will be equal in cost to —

- 1½ times the Department of Education budget;

- larger than the budget of the Department of Veterans Affairs or the Department of Transportation; and

- nearly nine times the size of the EPA budget.

End Note:

1. Comparable figures for the tax cut and agency budgets are calculated as follows. Agency budget figures are the average of an agency's actual expenditures in 2001, OMB's estimate of the agency's expenditures in 2002, and OMB's estimate of the President's budget request for the agency in 2003. The resulting average represents current costs with year-to-year anomalies smoothed out. The cost of the tax cut is based on CBO's estimate of its cost in 2011 if all its provisions are made permanent (as well as a Joint Tax Committee estimate of the cost of ensuring that the tax cut does not cause the number of tax filers subject to the Alternative Minimum Tax to increase above its previously projected path; the tax cut legislation enacted last year contains a provision to accomplish this goal, but the provision currently is scheduled to expire at the end of 2004; see The Administration's Proposal to Make the Tax Cut Permanent, Center on Budget, revised April 17, 2002, page 5). By 2011, when the full costs of the tax cut first appear, this estimate of the tax cut equals 1.8 percent of GDP. To make this figure comparable to the figures for agency budgets, the tax cut is then calculated as 1.8 percent of GDP for 2002. In effect, this approach constitutes an estimate of the cost of the tax cut in 2002 if all of its provisions had been fully effective by the beginning of 2001. The share of the fully-effective tax cut applicable to the top one percent of the population was calculated by William Gale and Samara Potter in a Brookings Institution paper that is available on the Brookings website and will shortly be published in the National Tax Journal.