| FOR IMMEDIATE RELEASE: March 30, 2000 |

CONTACT:

Robert Greenstein |

Social Security Report Shows

Continued Improvement, but Action Still Is Needed

Trustees' Forecast Suggests that Moderate Steps,

Taken Soon, Can Restore Solvency for 75 Years, Without Radical Changes

Today's report from the Social Security trustees' provides good news about Social Security's financial condition but also shows that action continues to be needed to restore long-term solvency to the system, according to an analysis from the Center on Budget and Policy Priorities.

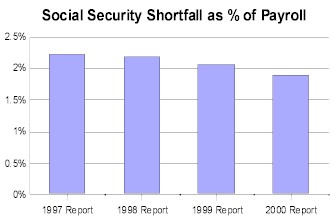

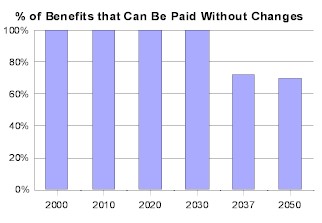

Today's report is the third consecutive annual report in which the forecast was brighter than the previous year's. The report shows that an increase in the Social Security payroll tax of less than one percent on both employers and employees would keep the system secure and able to pay promised benefits for the full 75-year period the report covers. The report also indicates that if no action is taken, Social Security will be able to pay about 70 percent of promised benefits, rather than 100 percent, starting in 2037.

The report demonstrates, the Center's analysis said, that fears that Social

Security will be unable to pay any benefits a few decades from now — and will no

longer be around — are unfounded. The Center also noted that the trustees' forecast

indicates the Social Security shortfall can be closed with fairly modest steps if taken

soon. Radical restructuring of the system, such as beginning to replace part of Social

Security with private accounts, is not necessary to close this financing gap.

The report demonstrates, the Center's analysis said, that fears that Social

Security will be unable to pay any benefits a few decades from now — and will no

longer be around — are unfounded. The Center also noted that the trustees' forecast

indicates the Social Security shortfall can be closed with fairly modest steps if taken

soon. Radical restructuring of the system, such as beginning to replace part of Social

Security with private accounts, is not necessary to close this financing gap.

But real, rather than cosmetic, steps are needed to address the shortfall, the analysis said. It warned that a Social Security "lockbox" designed to prevent Social Security surplus revenues from being used to help finance other programs or tax cuts does not qualify as such a step, as it would provide no additional resources to Social Security and neither reduce the long-term actuarial imbalance in the program nor extend the date after which Social Security is no longer able to pay full benefits.

The analysis notes that it is unlikely any plan to restore

solvency will be able to pass Congress in the next several years if the plan does not

devote some projected non-Social Security surpluses to the retirement system.

Majority support in Congress for the benefit and/or payroll tax changes that otherwise

would be needed would be difficult to obtain. To be enactable, a package to restore

long-term Medicare solvency also is likely to require a substantial amount of revenue from

the rest of the budget.

The analysis notes that it is unlikely any plan to restore

solvency will be able to pass Congress in the next several years if the plan does not

devote some projected non-Social Security surpluses to the retirement system.

Majority support in Congress for the benefit and/or payroll tax changes that otherwise

would be needed would be difficult to obtain. To be enactable, a package to restore

long-term Medicare solvency also is likely to require a substantial amount of revenue from

the rest of the budget.

As a result, the Center said, the trustees' report should act as a warning light to policymakers not to expend most of the projected non-Social Security surpluses on tax cuts or program increases before Congress and the White House make any progress toward determining what steps to take to restore Social Security and Medicare solvency. If most of the projected non-Social Security surpluses are committed for other purposes now, that would preclude significant budget transfers for Social Security and Medicare, which in turn could render it difficult, if not impossible, for the foreseeable future to fashion solvency packages that can pass.

"The prudent course," the analysis states, "is to defer enactment of large tax cuts or spending increases until overall decisions can be made, in the context of deliberations on national priorities, concerning how much of the non-Social Security surpluses to reserve for use as part of Social Security and Medicare solvency proposals that have a potential for enactment."

The Center on Budget and Policy Priorities

is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

# # # #