|

March 21, 2007

THE 2001 AND 2003 TAX CUTS AND SMALL BUSINESS

By Aviva Aron-Dine and Robert Greenstein

The Bush Administration and Congressional supporters of the 2001 and 2003 tax cuts have often asserted that these tax cuts, and especially the reductions in the top two income tax rates, are of great value to small business. They argue that failure to extend these tax cuts would cause significant harm to small business owners.

An examination of the relevant data demonstrates, however, that such statements seriously exaggerate the benefits the tax cuts provide to the vast majority of small businesses. The tax cuts have indeed provided significant tax breaks to a small, elite group of households with some small-business income. But for the vast majority of such households, the tax cuts offer far more limited benefits, and the reductions in the top income tax rates offer no benefits at all.

Moreover, many of the high-income households that have gained the most from the tax cuts do not conform to the popular conception of a “small business owner.” The Treasury Department’s definition of a small-business owner includes wealthy individuals, many of them passive investors, who derive only a small fraction of their total income from a small business.[1]

Reductions in the Top Income Tax Rates Affect Tiny Minority of Small Businesses

The 2001 tax legislation reduced the top income tax rate from 39.6 percent to 35 percent and the next-to-top tax rate from 36 percent to 33 percent. Supporters of making these rate reductions permanent have argued that doing so is vital for small businesses. They claim that a large share of those who face the top rate are people with small-business income, a group the Administration and other tax-cut supporters often refer to as “small business owners.” (See discussion below of why this terminology is misleading.)

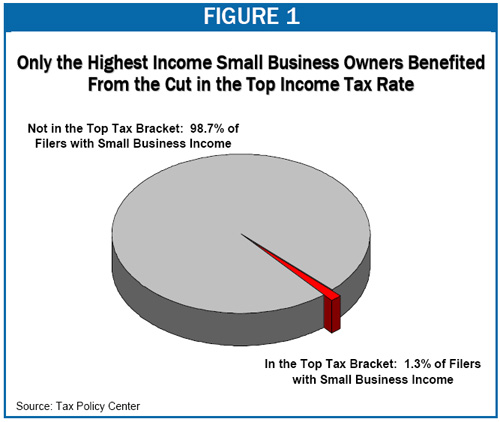

Estimates by the Urban Institute-Brookings Institution Tax Policy Center shows, however, that the number of tax filers with small-business income who face the top income tax rates represents only a tiny fraction of all tax filers with small-business income. [2]

-

The Tax Policy Center data show that only 436,000 filers with small-business income — just 1.3 percent of all such filers — were subject to the top income tax rate in 2004 and hence benefited from the top-rate reduction. The remaining 98.7 percent of households with small business income were not affected by this change. (See Figure 1.)

-

Similarly, only 859,000 filers with small-business income — just 2.6 percent of all such filers — were subject to either of the top two income tax rates. More than 97 percent of households with small business income did not benefit from either rate reduction.

The Tax Cuts for “Small Businesses” Are Flowing Primarily to Those With High Incomes

If the reduction in the top tax rates do not affect the overwhelming majority of small businesses, the question arises as to whether the overall package of tax cuts enacted since 2001 offers something special to a broader group of small businesses.

In fact, the tax cuts affect small business in much the same way that they affect the population as a whole. The tax cuts enacted since 2001 have disproportionately benefited those with the highest incomes. Similarly, the tax-cut benefits that have gone to filers with small business income have gone disproportionately to people at the top of the income scale.

Among households with small-business income, the Tax Policy Center data show that in 2004:

-

Households whose annual income exceeded $1 million received an average tax cut of about $130,000. This group, which encompassed only 0.6 percent of all households with small-business income, received 27 percent of all of the tax-cut benefits provided to households with small business income. (See Table 1.)

-

Households whose annual income exceeded $200,000 received tax cuts averaging $21,000. This group encompassed 8 percent of all households with small-business income, but received more than half of the benefits that the tax cuts provided to households with small-business income.

|

Table 1:

Distribution of the Tax Cuts Among Households

With Small-Business Income in 2004

|

|

Cash Income Group |

Average Tax Cut |

Share of Households With Small-Business Income |

Share of Tax Cuts Going to Households With Small-Business Income |

|

Less than $50,000 |

$540 |

|

45 |

% |

8 |

% |

|

$50,000 - $100,000 |

$1,800 |

|

29 |

% |

17 |

% |

|

$100,000-$200,000 |

$4,100 |

|

17 |

% |

23 |

% |

|

Above $200,000 |

$21,000 |

|

8 |

% |

51 |

% |

|

Above $1 Million |

$130,000 |

|

0.6 |

% |

27 |

% |

|

Source: Urban-Brookings Tax Policy Center. |

-

By contrast, households with small-business income whose total incomes fell below $50,000 received tax cuts averaging $540. This group constituted 45 percent of all households with small-business income; but it received 8 percent of the tax-cut benefits going to such households.

Administration Definition of “Small-Business Owner” Inflates Estimates of Tax-Cut Benefits Going to Small Business Owners

The power of the term “small business” lies in the image it evokes in the public imagination. Typically, it brings to mind risk-taking entrepreneurs who are involved in the hands-on management of their small firms. To some people, it calls to mind the corner grocery store owner or the local auto mechanic. To others, it suggests a start-up firm, such as a new business developing a new type of software.

Yet the definition of small-business owner used by the Administration in its estimates — and used by the Tax Policy Center to be consistent with the Treasury definition — includes large numbers of tax filers who are not hands-on entrepreneurs. The Administration’s estimates count as a small business owner any tax unit that includes any income (or loss) from a sole proprietorship, farm proprietorship, partnership, S corporation, or rental income.

This expansive definition suffers from two problems. First, it counts as tax cuts for small businesses billions of dollars in tax benefits that go to individuals whose businesses are not “small.” Second, it counts as tax cuts for small businesses tax benefits that go to wealthy individuals who are passive investors and have nothing to do with operating the business in question (and may never have set foot in it).

What Does “Small” Mean?

As the Joint Committee on Taxation has noted, “while many small businesses are arranged as a sole proprietorship, a partnership, or an S corporation, not all of the businesses organized in these forms are small…”[3] Using IRS data from 2003, the Joint Tax Committee showed that the Treasury definition of “small business” included 770,000 businesses with gross receipts of over $1 million and 86,000 companies with gross receipts of over $10 million. Businesses with gross receipts of more than $10 million accounted for about two thirds of the gross receipts of all partnerships and S corporations.

What Makes Someone a “Small-Business Owner”?

The Treasury definition includes many wealthy individuals who are passive investors, not small-business proprietors. According to the Tax Policy Center, passive income from partnerships and S corporations accounted for some or all of the small-business income of 2.9 million tax filers who were termed “small-business owners” under the Treasury definition in 2004. For 850,000 of these filers, all of their “business income” came in this passive form.

It is of particular note that the prevalence of passive business income increases at higher income levels. Passive investment income constituted all or part of the business income of about 9 percent of all households counted as small business owners under the Treasury definition. But about 35 percent of the “small-business owners” with incomes above $200,000, and about 58 percent of the “small-business owners” with incomes over $1 million, received some or all of their “business income” in this form.

The Treasury definition also counts as “small-business income” the fees that CEOs are paid for sitting on corporate boards, as well as honoraria that journalists receive for giving speeches. This turns a number of corporate CEOs and journalists employed by large media corporations into “small-business owners.” Doctors and lawyers who organize their practices as sole proprietorships, partnerships, or S corporations are considered small-business owners, as well, under this definition. Indeed, President Bush and Vice-President Cheney are considered “small-business owners” under this definition.

Conclusion

Small businesses typically evoke positive images in the public mind, and the Administration and other supporters of the 2001 and 2003 tax cuts have often sought to build support for these tax cuts by associating them with the small-business sector. Yet the benefits tax-cut supporters claim will flow to small businesses as a result of the tax cuts are greatly exaggerated. Few small businesses will see any benefit at all from the reduction in the top income-tax rates. Moreover, the distribution of the tax cuts as a whole among small businesses closely resembles their distribution among other households: by far the largest benefits flow to those with the highest incomes.

End Notes: [1] This analysis does not discuss claims that have been made regarding small businesses and the estate tax. For a discussion of those issues, see “The Estate Tax: Myths and Realities,” Center on Budget and Policy Priorities, revised February 7, 2007, https://www.cbpp.org/pubs/estatetax.htm. [2] This analysis is based on Tax Policy Center data for 2004. It will be updated when newer TPC data become available. [3] Joint Committee on Taxation, “Present Law and Background Relating to Selected Business Tax Issues,” JCX-41-06, September 19, 2003.

|