ADMINISTRATION'S FY 2005 BUDGET AN UNBALANCED

AND INEFFECTIVE APPROACH TO FISCAL DISCIPLINE

|

PDF of

fact sheet |

|

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

A new Center report, Analysis of the President’s Budget, finds the proposed budget would worsen the nation’s fiscal problems while largely exempting affluent and powerful constituents from measures to restore fiscal discipline. The budget:

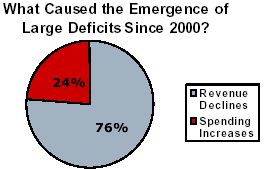

- Calls for more tax cuts despite the budgetary damage caused by declining revenues. By far the largest policy proposal in the budget is additional tax cuts — most notably, making the 2001 and 2003 tax cuts permanent. Yet federal revenues have fallen dramatically in recent years and now are at their lowest level as a share of the economy since 1950. As the chart shows, the decline in revenues is the main cause of the dramatic shift from robust surpluses to large deficits since 2000, accounting for 76 percent of that deterioration.*

- Cuts real funding for domestic discretionary programs in 2005. The budget increases funding for non-defense discretionary programs outside homeland security by 0.5 percent in 2005, less than the amount needed to compensate for inflation. Moreover, the 0.5 percent increase contains within it a 23 percent increase for international assistance programs and increases in funding for defense programs outside the Pentagon, such as the Energy Department’s nuclear weapons programs. Domestic discretionary programs outside homeland security would rise by 0.1 percent.

One particularly stark example of the cuts in domestic discretionary programs is the treatment of the housing voucher program, the nation’s principal low-income housing assistance program. Its funding for 2005 would fall more than $1.6 billion short of the amount needed to continue the vouchers that are in use, a shortfall that could lead to 250,000 fewer low-income families and elderly and disabled households receiving housing assistance.

- Contains increasingly large domestic discretionary cuts after 2005. By 2009, total funding for domestic discretionary programs outside homeland security would be $45.4 billion (10.4 percent) below the 2004 level, adjusted for inflation. These cuts would seriously weaken a range of programs. For example, cuts in child care funding would cause the number of children receiving child care assistance to fall by roughly 365,000.

The cuts proposed for 2006-2009 are largely hidden; for the first time in recent memory, proposed “out year” funding levels are not shown in the Administration’s budget books and can only be found in the 1,000-page OMB computer run that underlies the budget. Yet these cuts are a basic part of the budget. In fact, the Administration is proposing the enactment of discretionary spending caps that could lock in cuts of this magnitude.

While the discretionary spending cuts are being presented as a way of controlling the deficit, the amounts they would save in 2009 equal only a small fraction of the cost of the tax cuts. In fact, the combined savings from all of the domestic discretionary cuts would be substantially smaller than the cost of the tax cuts just for the top one percent of households, a group whose income this year exceeds $310,000.

- Exempts powerful interests from fiscal discipline. Under new rules proposed in the budget, future improvements in entitlement programs for low- and moderate-income families would have to be “paid for” so they do not increase the deficit, but new tax breaks for high-income families and corporations would not. This contrasts sharply with the “Pay-As-You-Go” rules of the 1990s, which helped move the nation from deficits to surpluses during that decade. Those earlier rules imposed fiscal discipline on entitlement increases and tax cuts alike, since both types of policy changes affect the deficit.

Furthermore, under the proposed budget rules, the only offsets that could be used to pay for entitlement improvements would be cuts in other entitlement programs. Tax savings, such as from closing abusive corporate tax shelters, could not be used for this purpose.

- Won’t cut the deficit in half. The Administration attempts to give the budget an aura of fiscal responsibility by claiming the budget will cut the deficit in half by 2009. This claim is not credible. The budget omits roughly $160 billion in costs in 2009 that the Administration itself favors and is expected to propose in future budgets. For example, it includes no Alternative Minimum Tax relief after 2005, implicitly assuming that about 30 million Americans will be subject to the tax by 2009; this clearly is not going to happen. The budget also shows no costs for the war on terrorism after September 30.

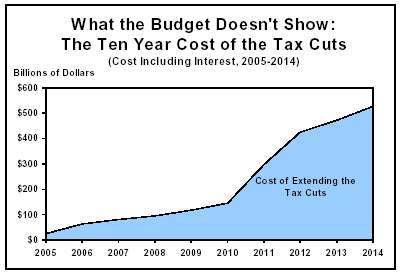

- Obscures the long-term effects of the policies it proposes. By showing deficit numbers for only five years, the budget conceals the worsening of the deficit that will occur after 2009 as a result of the proposal to make the tax cuts permanent (the bulk of whose cost comes after 2010) and the baby boomers’ retirement.

End Note:

* Between 2000 and 2004, the budget declined by an amount equal to 6.6 percent of GDP, from a surplus of 2.4 percent of GDP to a deficit of 4.2 percent of GDP. This was the largest budgetary deterioration in U.S. peacetime history. The steep drop in revenues — which fell by an amount equal to 5.0 percent of GDP during this period — was responsible for 76 percent of this deterioration.