PRESIDENT’S TAX PROPOSALS

WOULD REDUCE STATE REVENUES

BY $64 BILLION OVER 10 YEARS

By

Iris J. Lav

| PDF of full report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

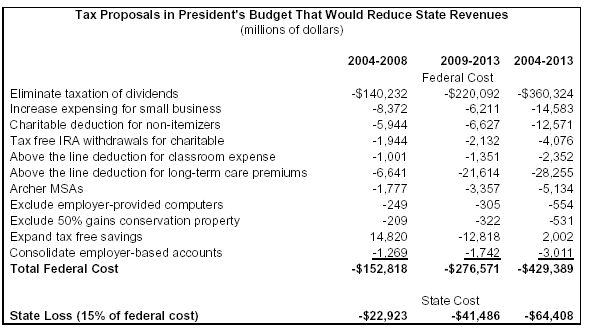

The provisions that would reduce state revenues include the elimination of the taxation of dividends, an increase in expensing for small businesses, a new charitable deduction for non-itemizers, an “above-the-line” deduction for long-term care insurance premiums, expansion of Archer MSAs, the consolidation of employer-based retirement savings accounts, and several others (see table). One provision — the expansion of Roth IRAs (renamed Retirement Savings Accounts) and the creation of the Lifetime Savings Accounts — appears to increase both federal and state revenues in the near term. Over time, however, these provisions would cause a large loss of revenue at both the federal and state levels.

According to the Administration’s budget, these 11 provisions will result in a net federal revenue loss of $153 billion in the five years between 2004 and 2008. The federal revenue loss grows to $277 billion in the subsequent five years from 2009 to 2013.As a rule of thumb, one can roughly estimate that aggregate state revenue losses from these types of tax cut provisions would equal about 15 percent of the federal revenue loss. Thus, if these provisions were enacted, states would stand to lose $23 billion between 2004 and 2008. As the proposed savings accounts grow in cost over time, so would the state revenue loss. The state revenue loss would rise to more than $41 billion over the subsequent five years from 2009 to 2013.

These revenue losses are on top of the state revenue losses that resulted from the 2001 tax law changes. In particular, the estate tax changes enacted in 2001, and which are made permanent in the President’s budget, have a $75 billion cost to states in the 2004-2013 period. While approximately one-third of the current cost of the estate tax changes to states has been avoided because 17 states are “decoupled” and thus have not incorporated the federal changes, it is unclear whether decoupling will be sustainable over the long term.