What Do The New Baseline

Budget Projections Mean?

How Much Is Available for Tax Cuts and Program Initiatives?

Executive Summary

by James Horney and Robert Greenstein

Click here for PDF version of the Full Report or Baseline Fact Sheet |

On January 26, the Congressional Budget Office (CBO) released new projections of federal revenues, spending, and surpluses for fiscal years 2001 through 2010. From some press reports, one might conclude that CBO has determined that surpluses in the non-Social Security part of the budget will total $1.9 trillion over the next 10 years and that tax cuts or entitlement benefit expansions costing as much as $1.9 trillion can safely be enacted.

In fact, CBO has projected that surpluses will total $838 billion over the next 10 years under reasonable assumptions about the path of discretionary (non-entitlement) spending over that period. (These assumptions regarding discretionary spending are probably conservative; as explained in this analysis, actual discretionary spending is likely to be higher.) Furthermore, CBO points out that the nation faces long-term budgetary problems related to the costs of growing numbers of baby-boom retirees and rising health care costs even if all of these projected surpluses are dedicated to debt reduction. Using a significant portion of the surpluses to fund large tax cuts or large increases in entitlement spending instead would exacerbate the long-term problem, unless meaningful reform of Social Security, Medicare, or other programs or tax expenditures is enacted at the same time.

The President's budget for fiscal year 2001 will be submitted February 7. Its baseline estimate of non-Social Security surpluses over the next 10 years is expected to be similar to, and probably a little smaller than, the $838 billion CBO projection.

According to CBO's projections, non-Social Security surpluses would total as much as $1.9 trillion over the next 10 years only on the assumption either that discretionary spending would comply with the statutory limits (or "caps") on such spending in 2001 and 2002 and grow at the rate of inflation thereafter or that discretionary spending will remain frozen at the 2000 level through 2010, without any adjustment for inflation for 10 years.(1)

Neither assumption is realistic. Total discretionary spending (which accounts for about one-third of all government spending) has kept pace with inflation for the past two years, despite caps that required deep cuts below the inflation-adjusted levels. Non-defense discretionary spending has grown faster than inflation in every year but one since the caps were instituted in 1991. (Non-defense discretionary appropriations provide funding for a wide array of government activities, including health and science research, veterans medical care, environmental programs, highway construction, Head Start, the Federal Bureau of Investigation, and the National Park Service.) Total discretionary spending grew more slowly than inflation from 1991 through 1998 only because defense spending was cut significantly in the years following the end of the Cold War. With a consensus apparently emerging among a majority in Congress and the President that defense spending should at least keep pace with inflation in coming years (and probably be increased above that level), it is exceedingly unlikely that total discretionary spending will grow more slowly than the rate of inflation over the next 10 years.

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2001-2010 |

|||||

Reductions Below FY 2000 Level Adjusted for Inflation |

||||||||||||||||

Baseline that Assumes a Freeze |

0 |

-11 |

-23 |

-42 |

-60 |

-77 |

-93 |

-110 |

-128 |

-146 |

-165 |

-854 |

||||

Baseline that Assumes Compliance with the Caps |

0 |

-57 |

-79 |

-83 |

-84 |

-87 |

-86 |

-84 |

-88 |

-89 |

-90 |

-827 |

||||

Source: Congressional Budget Office |

||||||||||||||||

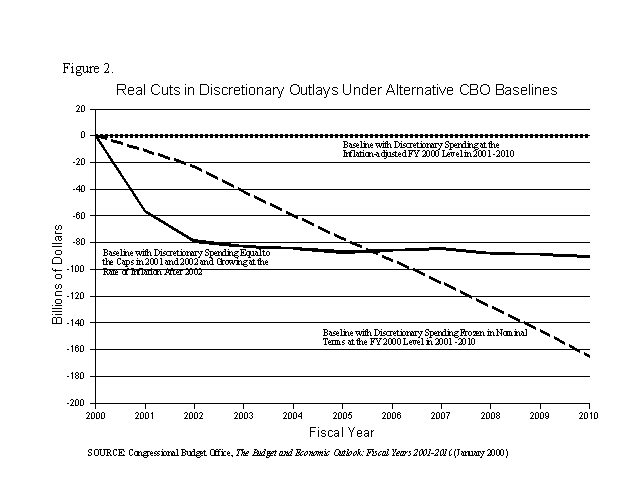

It is widely recognized that assuming adherence to the caps is unrealistic. Assuming a 10-year freeze on total discretionary spending is no less unrealistic. The new CBO report shows that a 10-year freeze would require making reductions in real discretionary spending (i.e., discretionary spending adjusted for inflation) totaling $854 billion over the next 10 years. By 2010, real discretionary spending would have to be cut more than 20 percent. If defense spending stayed even with inflation, a freeze in overall discretionary spending would require a cut in non-defense discretionary spending of close to 40 percent by 2010.

Under the more realistic assumption that discretionary spending will keep pace with inflation over the next 10 years, the projected non-Social Security surplus of $1.9 trillion that results from assuming adherence to the caps or a 10-year freeze is cut by more than half, to $838 billion. Even the assumption that discretionary spending will remain even with inflation is likely to prove conservative. If defense spending grows in real terms, as seems likely, non-defense spending would have to be cut in real terms for total discretionary spending to grow no faster than inflation. As former Congressional Budget Office director Robert Reischauer has observed, recent history suggests such reductions in non-defense discretionary programs are unlikely to occur. Moreover, as the nation's population and wealth grows, there is likely to be rising demand for increased spending on the non-defense side of the budget.

The $838 billion figure also overstates the likely non-Social Security surpluses over the next 10 years for another reason — it does not reflect certain entitlement and tax legislation that would continue policies currently in effect and is virtually certain to be enacted.

In each of the past two years, Congress has provided $6 billion to $8 billion a year in additional farm support payments (i.e., payments beyond those the Freedom to Farm Act provides). Given the political pressures, Congress is very likely to continue providing such additional payments to farmers. Congress also regularly extends for a few years at a time a series of popular tax credits that otherwise would expire, and it is a foregone conclusion Congress will continue to enact a so-called "extenders" bill every two years or so. Since CBO's surplus projections are based on current law, however, they assume no such legislation will be enacted — and hence that no additional payments will be made to farmers at any time in the next 10 years and that all of these tax credits will be allowed to terminate. Anticipated action in these two areas alone could slice more than $10 billion a year from the surplus projections.

In addition, virtually all observers agree that Congress and the White House will act to prevent the Alternative Minimum Tax (AMT), which was designed to curb tax avoidance by high-income taxpayers through excessive tax sheltering, from hitting millions of middle-class families that do not use tax shelters (and thereby raising their taxes), as will occur if the law governing the AMT is not changed. The AMT currently affects about two million tax filers; it will hit about 15 million by 2009 if no action is taken. Congress and any Administration are virtually certain to address this problem, which could cost up to $20 billion a year by 2010.

CBO's baseline does not reflect any of these costs. It effectively assumes Congress will stand by and allow millions of middle-class taxpayers to have their taxes increased by the AMT. The combined cost of the additional funding for farmers, legislation extending the expiring tax credits, and legislation to prevent such an increase in the impact of the AMT could be about $230 billion over the next 10 years. This would reduce projected non-Social Security surpluses that might be used for other purposes to about $600 billion over 10-years if total discretionary spending rises no faster than inflation despite likely defense spending increases.

It also is important to keep in mind that budget projections are inherently uncertain. As CBO notes, relatively minor changes in its assumptions about economic growth rates and growth in health care spending produce very large changes in projected surpluses. In its new budget forecast, CBO reports that under a somewhat more pessimistic scenario in which the economy generally performs as it did before 1996, the recent increases in personal income taxes as a share of taxable personal income prove temporary, and the annual growth rate of Medicare and Medicaid spending is just one percentage point higher than the CBO baseline assumes — assumptions that CBO describes as "clearly possible and also reasonable" — there would be non-Social Security deficits in each of the next 10 years, with those deficits totaling more than $2.9 trillion over the 2001-2010 period (and the national debt increasing rather than decreasing). Even a tiny change from CBO's forecast has consequences; if the economy grows at a rate just one-tenth of one percentage point lower over the next 10 years than CBO has forecast, the 10-year non-Social Security surplus would be about $150 billion smaller. Under a more "optimistic" scenario (which CBO believes to be as likely as the pessimistic scenario), in which the economy performs even better than the CBO baseline assumes, personal income taxes rise further as a share of taxable personal income, and Medicare and Medicaid grow more slowly than in the CBO baseline, budget surpluses would substantially exceed those CBO projects under its baseline assumptions.

Even if the baseline assumptions prove accurate, using the projected $838 billion in non-Social Security surpluses for large tax cuts or large spending increases is not without adverse consequences for the long-term budget outlook. CBO reconfirmed in December 1999 that even if there are no tax cuts or increases in entitlement spending — so that all of the non-Social Security surpluses, as well as all of the Social Security surpluses, are used to pay down debt — large and growing budget deficits will return several decades from now as large numbers of baby-boomers retire, with the deficits eventually mounting to levels dangerous for the economy. Unless significant progress simultaneously is made toward correcting the long-term budget imbalances, use of a large portion of the non-Social Security surplus to fund tax cuts or entitlement expansions would make the long-term problem still more serious.(2)

Reforms in Social Security and Medicare could somewhat ease these long-term imbalances. But enacting reforms that restore long-term Medicare and Social Security solvency and ease the long-term imbalances is likely to prove politically impossible unless a substantial portion of the projected non-Social Security surpluses is provided to Social Security and Medicare as part of these reforms. Restoring long-term solvency to Medicare and Social Security without any contributions from the non-Social Security surpluses would necessitate instituting Social Security and Medicare benefit cuts or payroll tax increases far beyond anything that is conceivable politically. Only if sizeable amounts from non-Social Security surpluses can be part of Medicare and Social Security solvency packages are such packages likely to enter the realm of political feasibility.

This is true for both "traditional" approaches and "privatization" approaches to addressing the long-term financing shortfalls in these programs. If a large portion of the projected non-Social Security surpluses are used for other purposes and too little is left for Social Security and Medicare solvency packages, enacting reforms in these two programs is likely to become even more difficult than it already is.

Ideally, until significant progress is made toward solving the long-term Medicare, Social Security, and overall budget problems, the President and Congress will abide by the current "pay-as-you-go" rules requiring that tax cuts or increases in entitlement expenditures be paid for by increases in other taxes or reductions in other spending. If as seems likely, however, meaningful Medicare and Social Security reform is delayed and pressure to tap the projected surpluses mounts, the President and Congress should proceed very cautiously. They should allocate only a relatively modest portion of the projected surpluses for other purposes to ensure that enough of the surpluses remains to facilitate Medicare and Social Security reform. They also should make sure the surplus is used only to address the highest priority needs, such as reducing child poverty and reducing the number of families without health insurance. Large general tax cuts and large but less-critical entitlement expansions should wait until reforms are implemented that improve the long-term budget outlook.

End Notes:

1. Freezing appropriations at the level provided in fiscal year 2000 (without any adjustment for inflation) would produce outlays $46 billion higher than the amount allowed under the cap in 2001 and $57 billion higher than the cap for 2002. The surpluses for these years would consequently be smaller under a freeze than if discretionary spending were to comply with the caps. But the story is different for the latter part of the 10-year budget period. Under the CBO baseline that assumes adherence to the caps, discretionary spending after 2002 is assumed to equal the 2002 cap plus inflation. By contrast, under a baseline that assumes a 10-year freeze on discretionary appropriations, discretionary outlays do not grow with inflation and remain essentially flat all of the way through 2010. In the latter years of the 10-year period, discretionary spending would be lower under the baseline that assumes a freeze — and projected budget surpluses consequently would be larger — than under the baseline that assumes adherence to the caps. For example, discretionary outlays would be $74 billion lower in 2010 under a baseline that assumes a freeze than under the baseline that assumes compliance with the caps. Total discretionary spending — and total surpluses — over the 10-year period as a whole would be roughly the same under both approaches.

2. Some public investment expenditures can, like private investment expenditures, increase total economic growth and ease the long-term budget problem. Most public investment is made through discretionary programs, which are funded on a year-to-year basis. This means that additional public investments can be made through certain discretionary programs for a number of years without permanently locking in that additional spending, as would be the case with tax cuts or entitlement expansions. Consequently, increases for discretionary programs carefully targeted on public investment activities that are likely to produce subsequent economic pay-offs have the potential to produce modest positive, rather than negative, impacts on the long-term budget outlook. Among the categories of spending generally thought to constitute public investments are education, job training, infrastructure, research and development, and early intervention programs for children. It should be recognized that not all programs in these categories are effective in producing long-term payoffs.