TANF Expenditures Increased in the

Last Fiscal Year

by Zoë Neuberger

| PDF of report If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

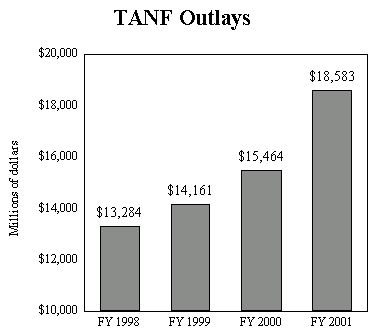

Data recently released by the Department of Treasury shows that states significantly increased their expenditures of Temporary Assistance for Needy Families block grant funds in fiscal year 2001 as compared with prior years. TANF outlays were $18.58 billion in fiscal year 2001, an increase of more than $3 billion over outlays in fiscal year 2000, according to the Final Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2001 (available at http://www.fms.treas.gov/mts/index.html). These new data suggest that states have expanded their use of TANF funds to provide important supports — including significant child care assistance — to low-income families.

Source: Final Monthly Treasury Statement of Receipts and Outlays of the United States Government, Table 5, for September of fiscal years 1998, 1999, 2000, and 2001. |

Since the first full year of TANF operations, fiscal year 1998, outlays have increased steadily each year. The increase between fiscal year 2000 and fiscal year 2001, however, was substantially greater than any prior growth — more than double the prior year increase of $1.3 billion. Although the Treasury report does not break down outlays by state or by expenditure category, these are the first available data on state TANF spending for the complete 2001 fiscal year. These data lend support to recent statements by some state officials that they have increased their TANF expenditures in the last year and consequently are concerned about being able to maintain funding levels for important TANF-supported programs as the economic downturn increases the number of families needing basic assistance. If states increase TANF expenditures on cash assistance and do not have access to additional federal funding, they might scale back programs that support low-income working parents or provide job preparation services for parents with significant barriers to employment.

The $18.58 billion in outlays in fiscal year 2001 marks the first year in which the states collectively expended more funds than they received for that year from their annual TANF block grant allocations. (States were able to do this by drawing down a significant amount of unspent funds from prior years.) The 1996 welfare legislation that created the TANF program provides a total of $16.5 billion each year in basic TANF block grants to the states. Some states have also received supplemental grants or performance bonuses; these grants and bonuses totaled $600 million in fiscal year 2001. The large increase in outlays in fiscal year 2001 suggests that states are making fuller use of their federal TANF funds to strengthen programs for low-income families.

TECHNICAL APPENDIX

More detailed TANF expenditure information will be reported to HHS by the states in mid-November. The data that states are required to report, however, are not exactly comparable to the outlay data reported by the Treasury Department. States have been permitted to transfer up to 30 percent of the TANF grant each year to the Child Care and Development Fund or the Social Services Block Grant, with no more than 10 percent permitted to be transferred to SSBG. Once transferred, the state has three years to spend CCDF funds and two years to spend SSBG funds. When transferred funds are actually spent, they appear in the Treasury data as TANF outlays.

In contrast, when states report on their spending to HHS, they include the total amount of funds that have been transferred without specifying whether those funds have been spent. Some transferred funds may not yet have been used in the CCDF or SSBG programs, but those funds are not reported to HHS as unliquidated obligations or unobligated balances within TANF. As a result, funds that are shown as having been "expended" in HHS's data (and the Center's analyses of data reported to HHS) are actually a combination of funds spent through the TANF program and funds transferred to CCDF and SSBG that may or may not yet have been spent. This problem is not present in the Treasury data.

Some of the increased expenditures reported by Treasury may be expenditures of funds transferred to either CCDF or SSBG in prior years rather than expenditures of newly transferred funds or expenditures in the TANF program itself. The Treasury data are consistent between years, so data from earlier years also include expenditures of funds from prior-year transfers. While it is likely that some portion of the increased outlays in fiscal year 2001 consists of increased spending of funds transferred in prior years, it also is likely that a significant portion is due to increased spending of non-transferred funds in the TANF program.