SWELLING DEFICITS:

INCREASED SPENDING IS NOT THE PRINCIPAL CULPRIT

Recent Spending Growth Leaves Federal

Expenditures Below Historical Levels

By

Richard Kogan

| PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

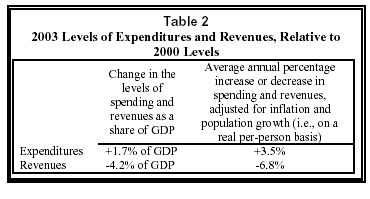

On October 20, the Treasury closed the books on fiscal year 2003 and reported a deficit of $374 billion. At about 3.5 percent of Gross Domestic Product, the deficit is high by historical standards, high enough so that it must be reduced significantly in the years ahead if the nation is not to suffer from a rising debt burden.[1] A recent report by the Center on Budget and Policy Priorities discusses falling revenues and the role of tax cuts in this year’s deficit.[2] This analysis looks briefly at the level of expenditures and the role of recent spending increases, and reaches two main conclusions. First, while spending has grown over the last three years, it remains at relative low levels by historical standards. Second, revenue losses are roughly twice as significant as spending increases in turning the budget from surplus to deficit over the last three years. (See Table 2.)

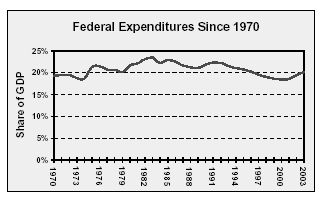

The figure below shows the level of federal expenditures since 1970 as a share of GDP.[3] Measured this way, federal expenditures shrank to their lowest level in decades by 2000. Spending rebounded very slightly in 2001 and more rapidly in 2002 and 2003. But while the rebound in spending is substantial, federal expenditures remain at relatively low levels by historical standards. Specifically, at 20.1 percent of GDP in 2003, federal expenditures —

-

were lower than in any year from 1975 through 1996;

were lower than in any year from 1975 through 1996;

- were lower than the average level from 1970 through 2000 (which was 20.9 percent of GDP); and

- were significantly lower than the level of expenditures at corresponding periods of past business cycles (that is, during periods of economic slumps). Expenditures averaged 21.4 percent of GDP in 1975/76, 22.3 percent in 1991/92, and 23.3 percent in 1982/83. In each of these three periods, the budget was suffering from the effects or after-effects of recession, as it is now. During such periods, federal expenditures rise as a share of GDP both because GDP is temporarily depressed and because expenditures for such programs as unemployment compensation are temporarily higher than normal.

To be sure, the recent increase in expenditures as a share of GDP is not exclusively the result of the recent recession. Expenditures have been rising over the last three years in all areas of the budget other than interest payments on the debt.[4] We can see this by tracking spending levels, as adjusted for inflation and population growth; this type of measurement is less affected by the business cycle because falling GDP is not part of the calculation. Overall, real per-person spending has grown an average of 3.5 percent per year over this period.[5]

|

Defense & homeland security |

9.0% |

|

Medicare & Medicaid |

6.3% |

|

Social Security |

2.2% |

|

Interest on the debt |

-14.2% |

|

All other programs |

5.7% |

|

Average of all programs |

3.5% |

Spending for defense and homeland security has grown faster than any other area of the budget. On a real per-person basis, this area of the budget has grown at an average annual rate of 9.0 percent per year over the last three years. (In fact, it hardly grew in 2001, meaning it has grown even more rapidly in the last two years.) Real per-person expenditures for Medicare and Medicaid have grown at an average annual rate of 6.3 percent over the same period, primarily because of rising health care costs that are affecting the public and private sectors alike and also because of the provision of extra federal Medicaid payments to states as an aspect of temporary state fiscal relief, enacted in the spring of 2003.[6] Real per-person expenditures for programs in the “all other” category have grown at an average annual rate of 5.7 percent over the same period. Growth in the latter category is affected by temporary increases in the cost of unemployment compensation and some other programs that respond to increased unemployment, as well as by the temporary fiscal relief to states enacted earlier this year; these temporary increases will disappear as the economy recovers.[7]

Expenditure vs Revenues

In 2000, the surplus reached 2.4 percent of GDP, almost its highest level in history.[8] Since then, revenues have fallen and spending has risen. Over this three-year period, the drop in revenues is roughly twice as significant as the increase in expenditures, as Table 2 shows.

Summary

Federal expenditures have recently risen from levels that were unusually low by the standards of the last three decades. Some of that increase is caused by the weak economy and is likely to be temporary, while the fastest increases have come, not surprisingly, in expenditures for the military and for homeland security. Overall, the current level of expenditures remains relatively low by historical standards, especially considering the combination of a weak economy and the high pace of military expenditures.

However measured, the decline in revenues has been roughly twice as significant as the increase in expenditures in turning the budget from large surpluses to large deficits.

End Notes:

[1]

For a discussion of the dangers attendant on large deficits in this

decade and future decades, see the joint statement and analysis of

[2] Isaac Shapiro, Federal Income Taxes, as a Share of GDP, Drop to Lowest Level Since 1942, According to Final Budget Data, Center on Budget and Policy Priorities, October 20, 2003, at https://www.cbpp.org/10-21-03tax.pdf.

[3] GDP is a basic measure of the size of the economy. When comparing budget figures over time, it is often better to show them as a share of the economy than in dollar terms; it is the size of the economy that determines what the nation can afford — the standard of living its citizens can enjoy. The 2003 deficit of $374 billion is the largest ever recorded in dollar terms. At 3.5 percent of GDP, however, the 2003 deficit is slightly smaller than the 4.0 percent average of the mid- to late-1980s. Because that was the only period in the nation’s history in which the budget suffered from large deficits during a time of peace and prosperity, it is a dismal benchmark; current and projected deficits might thus be characterized as “not quite as bad as the worst peacetime deficits on record.”

[4] Interest payments have been falling because the Treasury has taken advantage of very low interest rates to refinance much of the outstanding national debt at lower rates, much as families have recently been able to refinance their mortgages at lower rates and reduce personal expenditures in that way. However, analysts expect interest rates to rebound in the future, at which point the cost of interest on the debt will begin to rise rapidly.

[5] Over long periods of time, in the absence of tax cuts or tax increases, real per-person revenues can be expected to grow at about the same rate as the economy, or about 2.2 percent per year. For that reason, real per-person spending growth of about 2.2 percent per year will not lead to increases in deficits and debt, absent tax cuts.

[6] Note that real per-person Social Security costs have been growing at the “sustainable” pace of 2.2 percent per year. Social Security costs generally rise faster than inflation and population growth because new retirees tend to have earned higher real wages during their working careers than existing retirees, and therefore have both paid more in payroll taxes and earned higher real Social Security benefits.

[7] The state fiscal relief enacted in the spring includes both a temporary increase in the federal share of Medicaid costs (mentioned previously) and temporary direct grants to states.

[8] Not counting the surplus in the Social Security trust funds, the federal budget was in surplus by 0.9 percent of GDP in 2000 and was in deficit by approximately 4.9 percent of GDP in 2003.